Hotel Cost Management Support – labour shortages & payroll costs

The cost-of-living crisis has grabbed all the headlines and indeed everybody’s attention, and whilst all of the current challenges are linked, labour shortages and controlling payroll costs have dropped down the media’s priority list of importance.

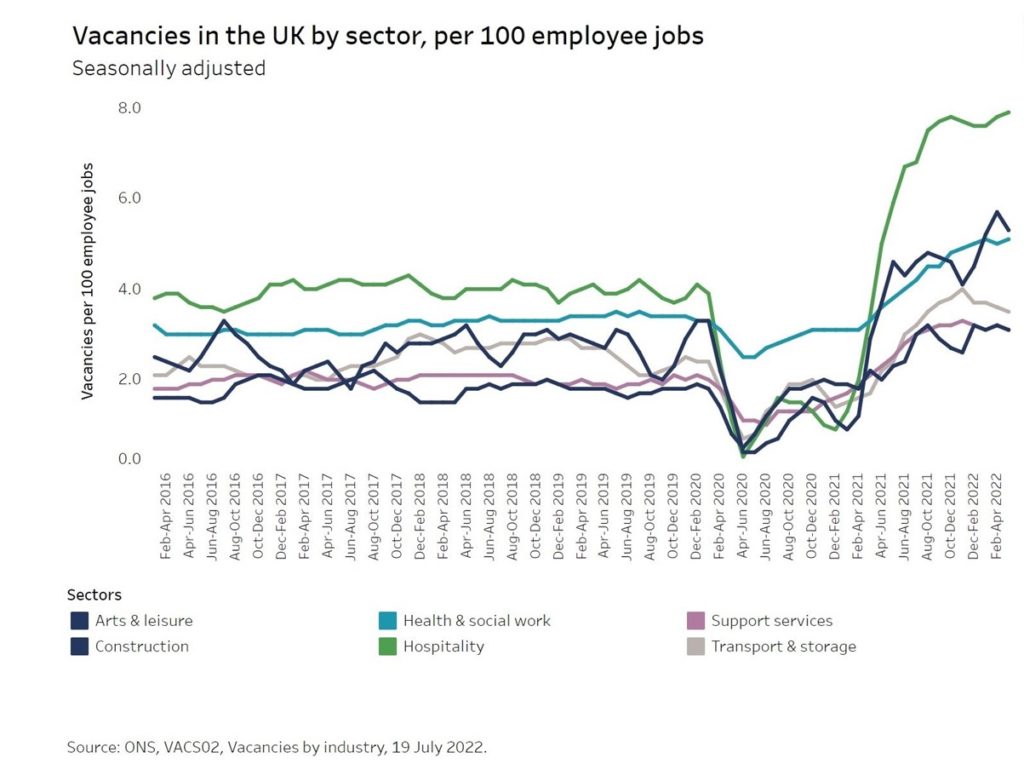

Labour shortages and payroll costs remain significant challenges which won't just disappear. The lack of personnel with the right skills and experience directly increases the cost of attracting and retaining the right people. We can see in the graphic below that the hospitality sector in the UK is fairing the worst by some distance amongst other similar-sized service-based sectors. As a result, we have seen some businesses forced to limit operating hours or even close facilities due to shortages.

In the current climate, limiting revenue-earning capacities can’t be a strategy of choice.

There are initiatives we can advise on and support hospitality and hotel businesses with, which include:

- Attracting more workers from the UK workforce, for example by raising wages, improving working conditions, or being more flexible on hours and contracts;

- Recruiting workers from abroad, usually by sponsoring them on a work visa*;

- Reducing the need for workers, for example by introducing automation by streamlining operations and administrative controls.

UK businesses are able to implement all of these initiatives now, including using immigration rules. Assured hotels can assist in assessing all available opportunities which could make a big difference in maximising income and controlling the highest cost in most trading businesses, ultimately converting better margins.

*Government policy post-Brexit means there are limitations however sponsorship is available as it stands.

Additional reading and resources on recruitment, retention, and labour costs in the UK….

- Staff shortages in the hospitality & retail sector – What help is there under the UK immigration rules? | Anderson Strathern

- How is the End of Free Movement Affecting the Low-wage Labour Force in the UK? - Migration Observatory - The Migration Observatory (ox.ac.uk)

Welcome to Assured Hotels

Assured Hotels offer specialist support to hotel owners and stakeholders, especially in Hotel Advisory and Asset Management capacities. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

Hotel Cost Management Support – Assured Hotels Turnaround Case Studies

The Energy Bills Support package announced by the Government last week was very welcome news, we have worked through the detail and will be publishing comprehensive guidance outlining utility cost management. This however is only part of the story, as pressures from declining revenues and rising costs across the board continue to erode margin and cash.

Most of our current caseload is trading administrations, where we are assisting stakeholders to preserve value to an exit. We can see that insolvencies of all types are returning 2019 levels, which given the pressures on trading businesses is inevitable.

However, these very final outcomes are avoidable in many cases. We are highly experienced in advising on hotel turnaround and restructuring. We therefore highlight several successful hotel projects where early intervention has made a difference:

Hotel turnaround to achieve refinance - 150 bed hotel with multiple outlets, in the Northwest

Group turnaround to disposal – hotel group consisting of 600 keys generating £20m annual turnover in the North of England

Single asset management led turnaround – lighter touch advisory support to the management team, of a 44-bedroom Southwest hotel

Welcome to Assured Hotels

Assured Hotels offer specialist support to hotel owners and stakeholders, in both Hotel Advisory and Asset Management capacities. We have been engaged in hotel turnaround and restructuring, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with emphasis on the development of the hotel's senior management team and therefore better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

DEMAND REPORT: Hotel occupancy recovery continues, while profit risks deepen

March/ April 2022

Since our last demand update report in February, the UK hotel sector has enjoyed consistent occupancy and revenue growth as Q1 draws to a close. However, since that time the world has faced an equal threat to covid, and our recovery is now exposed to different risks, mostly related to protecting profit margins.

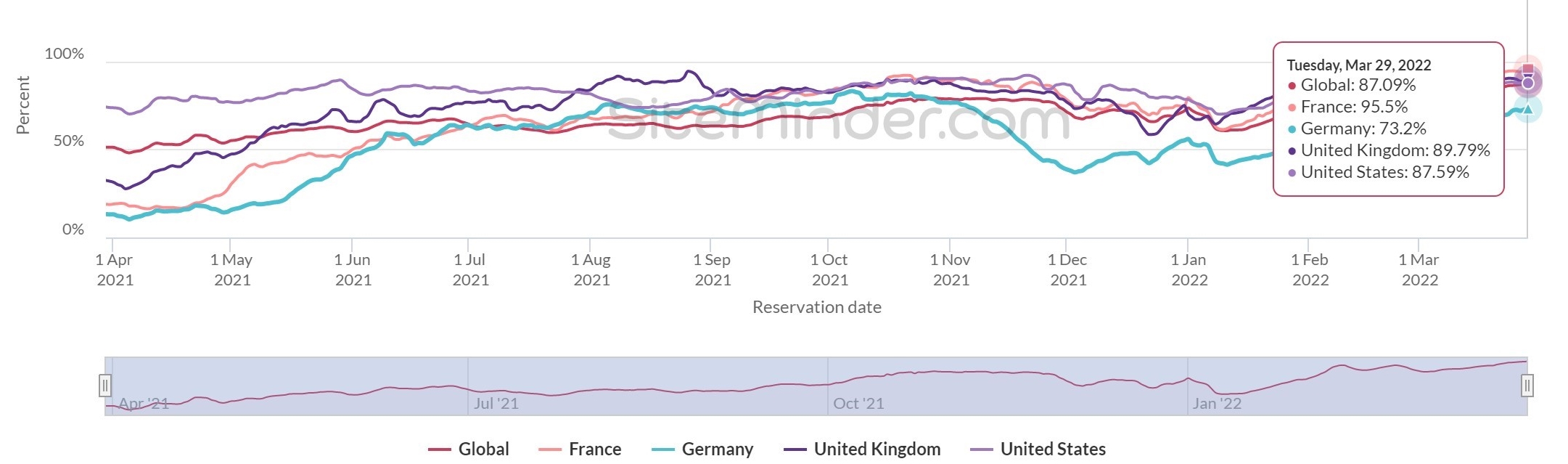

Firstly, an update of the current UK performance compared to other similar size economies shows we are continuing to fare well using SiteMinder’s World Hotel Index tool:

- UK is tracking 10% behind March 2020 occupancy, good news if we look back to the opposite end of the graphic and where we were in April ’21.

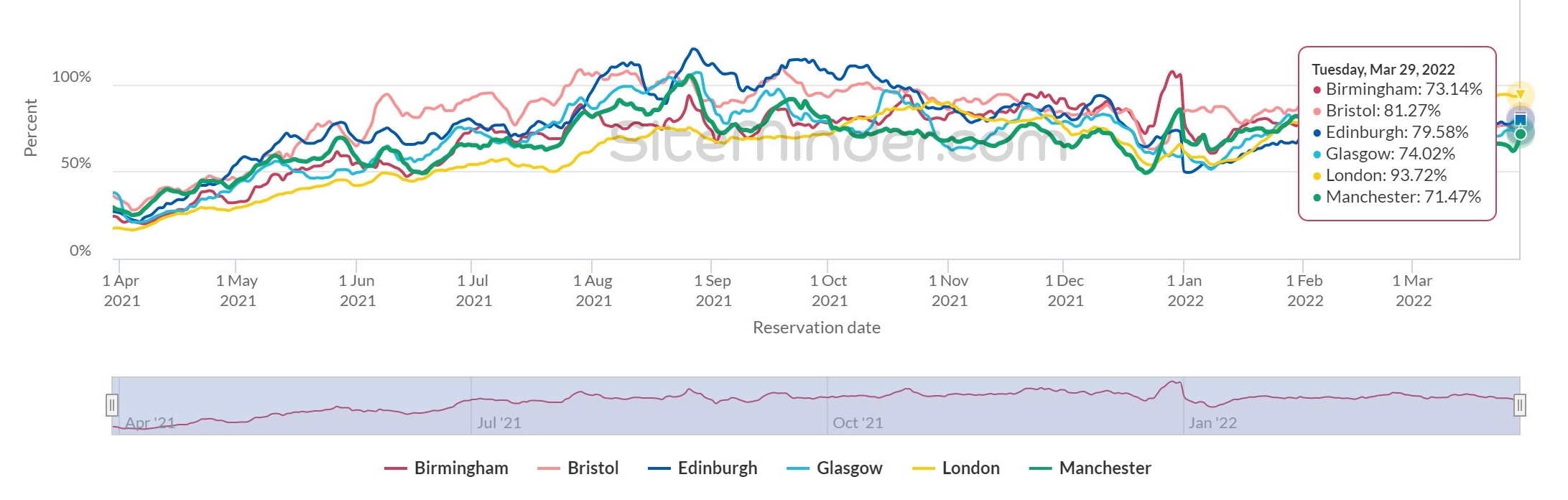

- UK Cities achieved mixed progress across the regions, London buoyed by a strong return of international travellers.

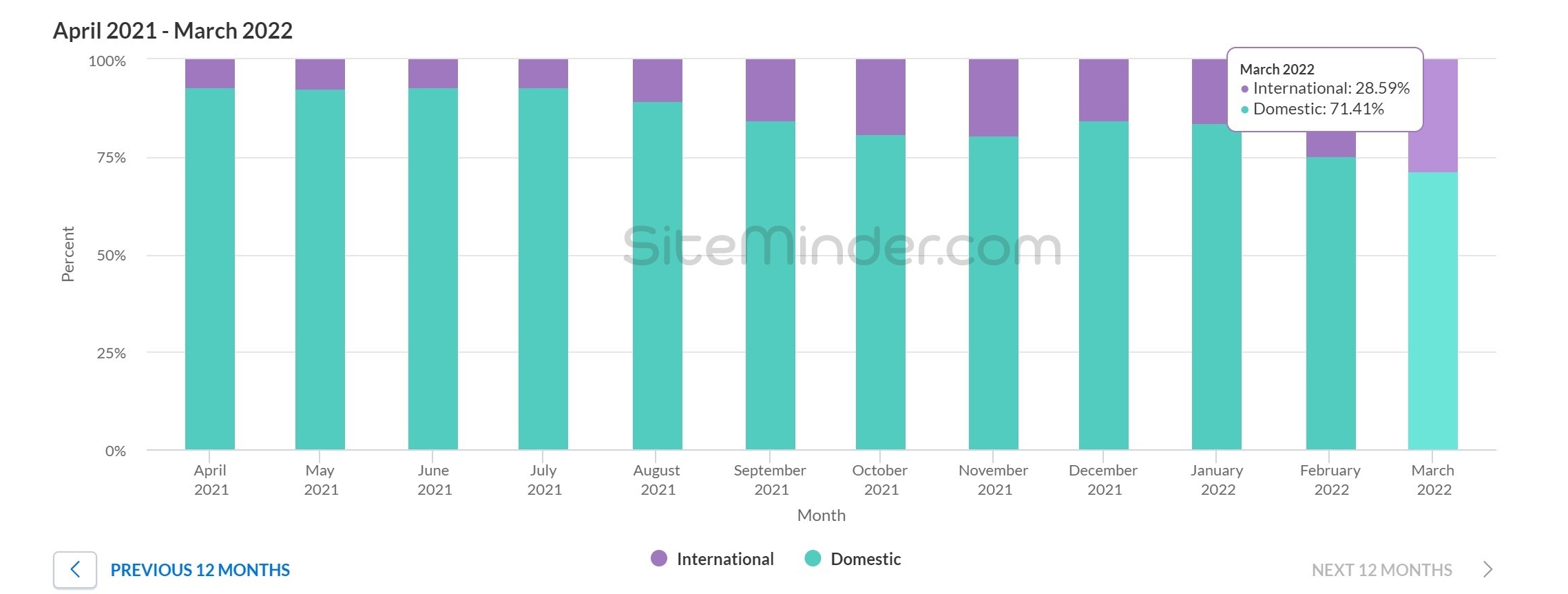

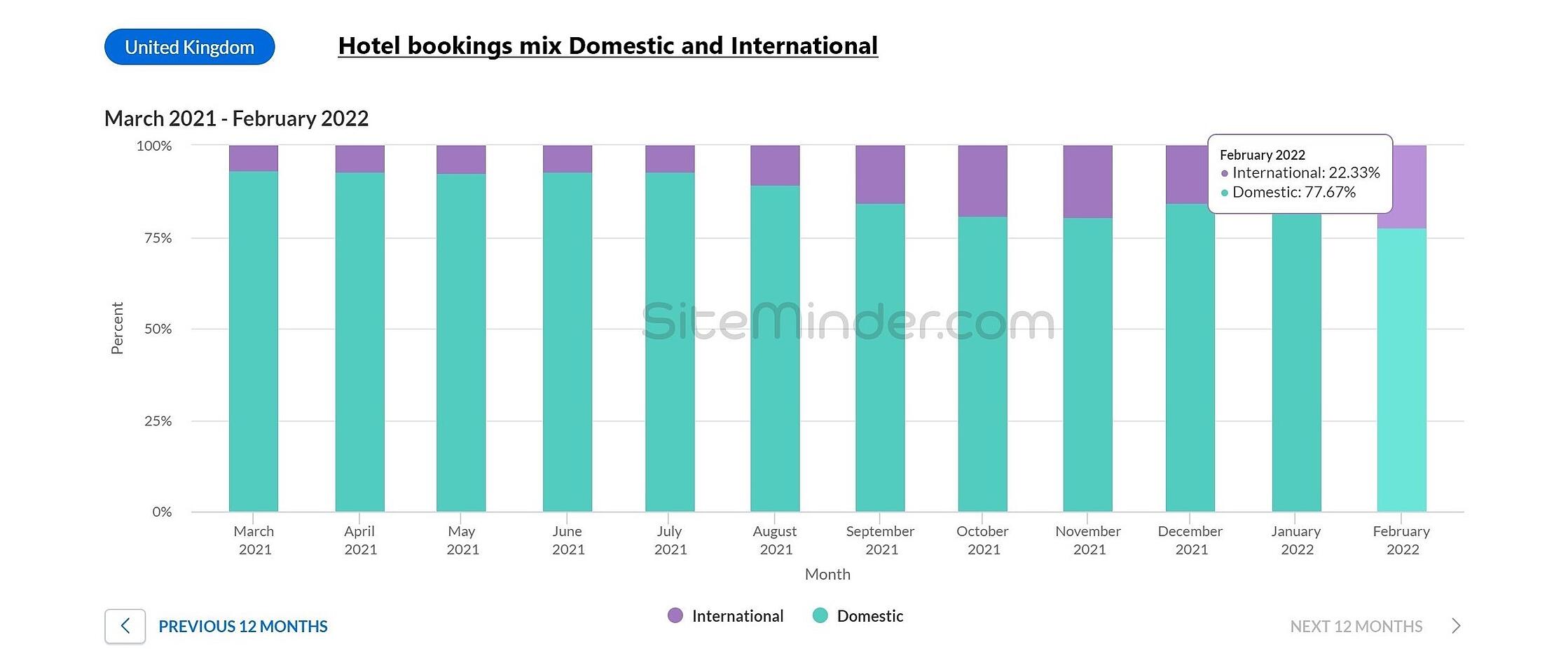

- Booking momentum mix, with international travellers making up a third of UK hotel bookings currently at 28.6%, March 2020 as the lockdown started this was less than 20%.

UK compared to the Rest of the World.

Booking Momentum – broad numbers show the UK only 10% down on traditional spring demand

Observations: in isolation this suggests a strong recovery getting towards pre-covid occupancies, however we need to factor other risks to get a full picture for forecasts into Q2 and beyond.

Observations: in isolation this suggests a strong recovery getting towards pre-covid occupancies, however we need to factor other risks to get a full picture for forecasts into Q2 and beyond.

UK cities focus, regional disparity continues

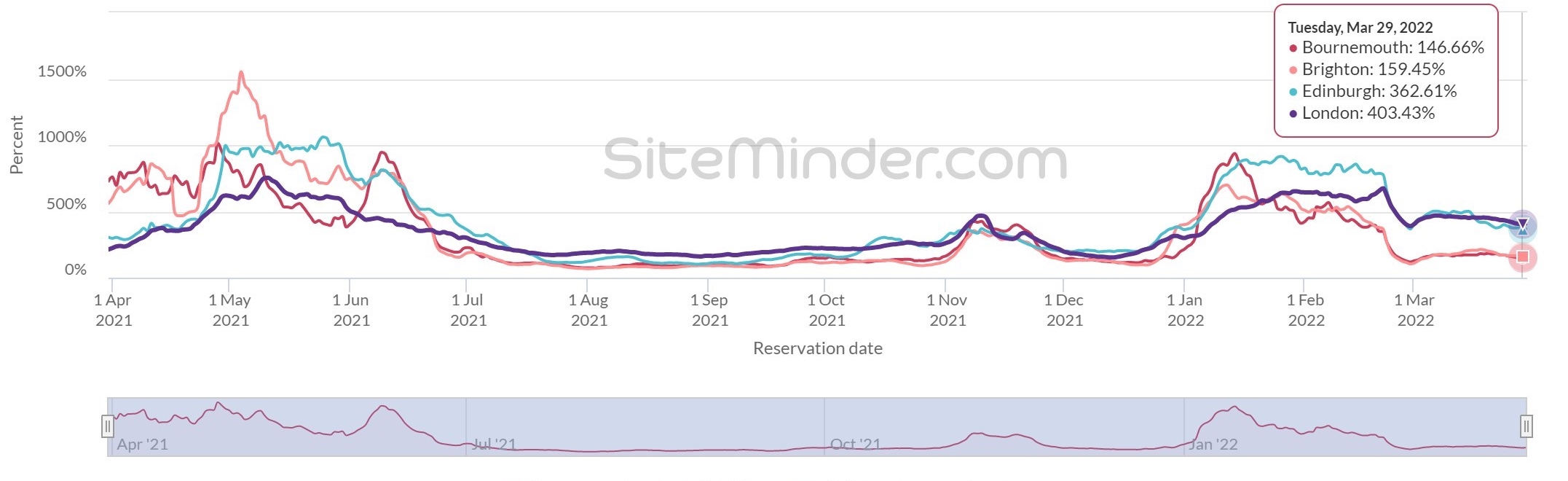

Booking Momentum by City - table below compares daily bookings made as a % of year prior, comparing momentum across a section of different UK destinations.

Observations: a mixed bag across different regions, with London leading the pack for the first time, no doubt as a direct result of returning international travel – see below.

Strong return of international travel

Booking Momentum mix - table below compares the mix of UK hotel bookings from domestic and international sources, March 2022 almost 30% of UK hotel bookings when March 2020 was under 20%.

Observations: as we have seen previously as restrictions lift pent up demand is driving higher levels of international travellers, will this sustain for forecasts as we move into the better weather?

So the general trends point to a sustained recovery with volumes growing back towards 2019/20 levels, which is consistent with other data sources, for example, if we look at this article from Hospitality Net with a specific focus on Europe and what looks like very little effect from the situation in Ukraine.

Profit margins at risk

However, there are now other factors to consider as big risks when looking at Q2 forecasts, including:

- Hotel’s re-opening or returning from alternative use – data sets do not include all closed hotels or those used for temporary alternative uses over the past 24 months, businesses must look locally to see if this will dilute expected market share.

- Staycation 2022 we doubt will live up to 2020 and 2021 now restrictions on air travel have been removed. An early indication is Brighton and Bournemouth in the graphic below, these locations were leading the UK occupancy last year but trends are reversed in 2022.

- Labour shortages continue to limit capacities and increase salary costs just to retain teams and standstill. Additionally, National Minimum wage is set to increase on 1st April which equates to a 6.6% rise across the board if the gap between entry-level employees and supervisory/ junior management is to be retained.

- Covid arrears and forbearance end – the long list of accrued liabilities and arrears will now come into view, including, unpaid taxes to HMRC, unpaid creditors as the moratorium on insolvency ends 31st March, and forbearance on probably higher levels of borrowing and senior debt all need to be addressed.

- Supply pricing – the situation in Eastern Europe has exacerbated winter inflationary pressures, particularly food and general cost of sales items, utilities and fuel which impacts all cost and overhead lines.

- Forecasts therefore will not be straightforward, with capacities and demand uncertain alongside high inflation we are suggesting a need to re-evaluate financial drivers to establish new baseline norms and fully review operational structures and processes.

Assured Hotels have just launched a new website detailing how we offer specialist support to hotel owners and stakeholders, in both Hotel Advisory and Asset Management capacities. We have been engaged in hotel turnaround and restructuring, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of our clients.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines – sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with emphasis on the development of the hotel’s senior management team and therefore better returns for investors and stakeholders.

DEMAND REPORT: UK hotels - a light at the end of the tunnel?

We recently wrote an updated demand report published on LinkedIn, where we looked at the UK performance over a difficult winter after the onset of the Omnicron variant. Since this was written the UK has made significant strides towards reopening our economy fully, so we have updated the latest demand trends with particular focus on:

- UK comparison compared to a broad global trajectory, Germany & France, both with similar-sized economy & population and a larger international economy in the United States.

- UK City update, with continued growth towards pre-pandemic occupancies in most UK cities. Further evidence that this has in part been driven by a return of International travellers in the bookings mix.

Accurate forecasting in the quarter ahead into the spring is clearly critical, as expectations of sustained trading growth increase as financial support comes to an end.

Finally, we have set out examples of solutions we can provide to support management teams in making more accurate revenue forecasts to maximise margins and improve cash flow.

The UK compared to the Rest of the World

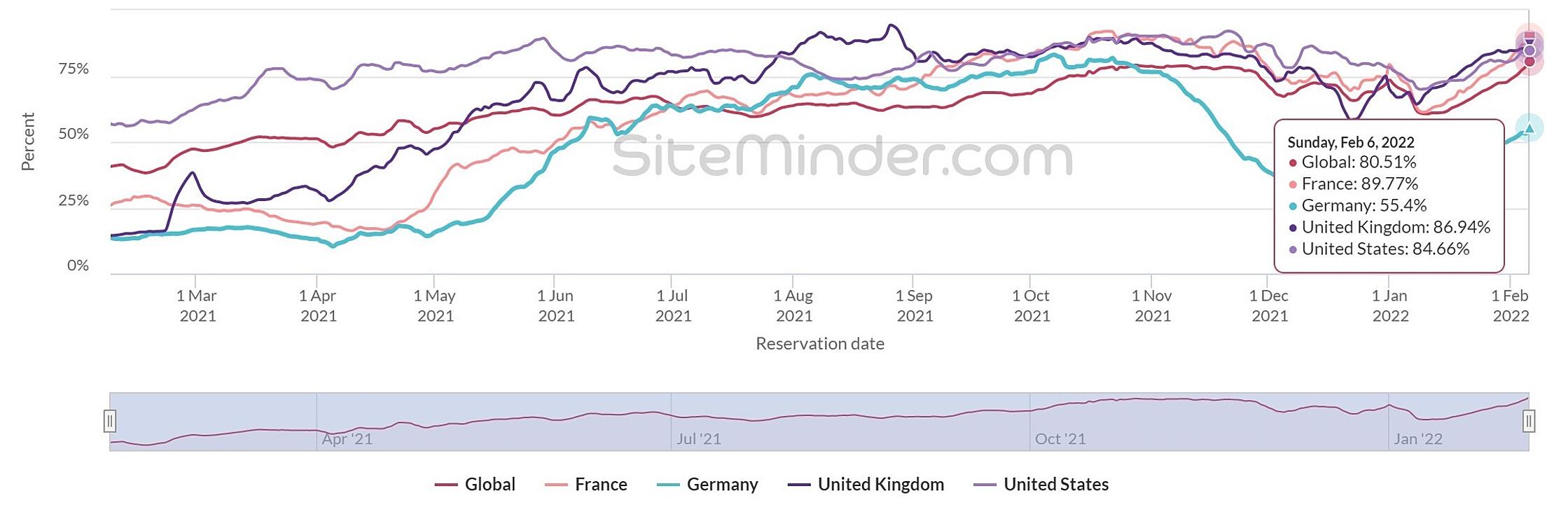

Booking Momentum - table below compares daily bookings made as a % of 2019/20, looking at the UK against the Global consolidated figure and the daily pace in Germany, France & the US.

The UK continues on an upward trajectory, now sitting at just under 87% of pre-pandemic trading, which is a 10% improvement from the start of this year. We can see this compares well with other similar economies.

The UK continues on an upward trajectory, now sitting at just under 87% of pre-pandemic trading, which is a 10% improvement from the start of this year. We can see this compares well with other similar economies.

UK cities focus, growth in International market mix

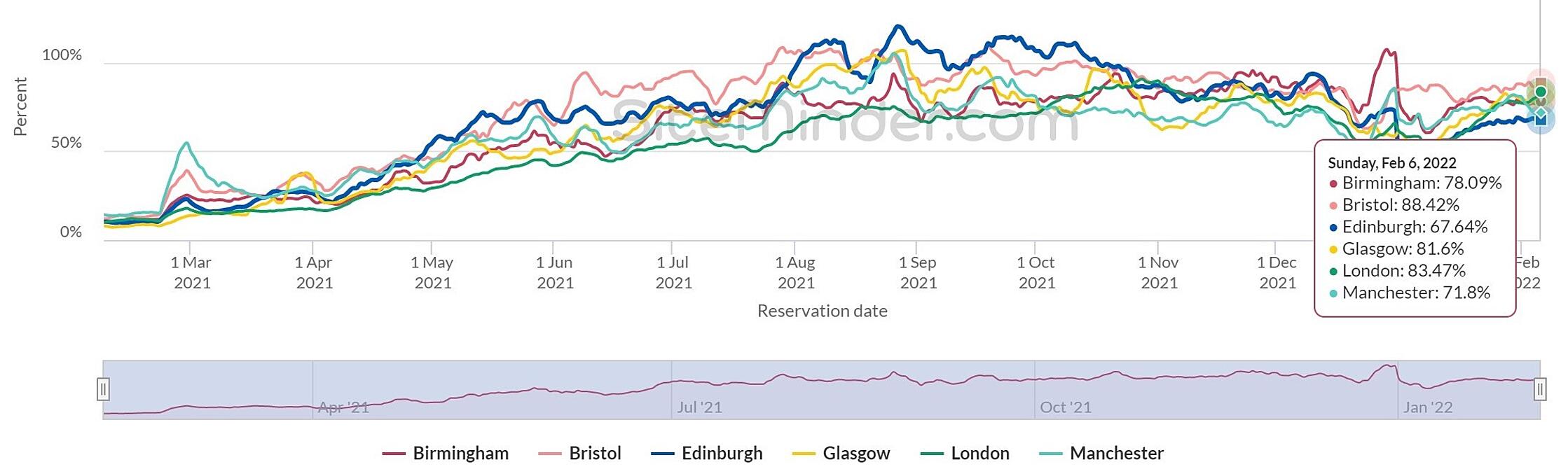

The selection of UK cities below shows the majority of business dominant centres are now sat above 80% of the levels of 2 years ago, with only Manchester going backwards since early January.

Booking Momentum by City - table below compares daily bookings made as a % of 2019/20, comparing momentum across a section of different UK destinations.

We can see in the second table below that this has been driven by a return of International travellers to these business centres as travel restrictions ease. February 2020 before 1st lockdown International travellers accounted for 23% of hotel stays in the UK, so we are close to that target to date in Feb 2022 with 22.33%.

We can see in the second table below that this has been driven by a return of International travellers to these business centres as travel restrictions ease. February 2020 before 1st lockdown International travellers accounted for 23% of hotel stays in the UK, so we are close to that target to date in Feb 2022 with 22.33%.

Booking Momentum mix - table below compares the mix of UK hotel bookings from Domestic and International sources.

As a mi

As a mi

Forecasting, Revenue Growth and Sales strategies

Sales and revenue strategies to ensure fair market share and accurate forecasting in in the period ahead. We have a team of dedicated revenue management and proactive sales resources available on a flexible basis. A member of our team could join a hotel team for as little as 4 hours a week which would also have the additional benefit of reducing payroll costs and removing some of the current challenges of staff shortages.

Assured Hotels can advise and implement on activity to drive revenue growth including a rate strategy & distribution review, to ensure the optimum rate is available across the right channels.

Sales & marketing initiatives must be planned to maximise exposure, and the past 2 years has thrown up a host of opportunities. As a minimum, we would recommend a review of lapsed corporate & leisure users and the agency connections which were in place before the pandemic - we have a long-standing relationship with a GDS (Global Distribution System) partner HotelREZ to check and challenge crucial connections into corporate and group markets.

Marketing must also be planned, for example, hotel own websites have grown to the 2nd best performing UK distribution channel and therefore must be refreshed and up to date with pay per click and key phrase campaigns. Direct mailing of offers to include family and leisure packages towards what will be another busy staycation from the spring. Using a database cleanse will also help raise awareness to previously regular customers.

This is just an illustration of where Assured Hotels can support sales and revenue teams - if you or a client has a hotel business, we are well placed to give an impartial sense check of all plans for a very low commitment on cost to ensure all opportunities are maximised as the sector recovers, particularly in relation to revenue-driving profit forecasts as Government support is removed.

Return of International traveller drives UK hotel occupancy

Positive hotel occupancy growth trends continue globally and are discussed regionally in this short article, which compares two periods of covid restrictions 2022 to 2021, demonstrating the return of International travel helping to drive UK hotel occupancy.

Assured Hotels January 2022 demand report – New Year solutions for hotel revenue growth out of the pandemic

Since our last demand update report in October and the onset of the new variant, we have experienced the familiar cycle of media-driven hype smashing consumer demand, which in our sector means stagnation and regression of hotel room revenues.

Whilst the worst numbers on infections and pressure on the NHS is probably yet to come, the Government’s stated balanced strategy with no plans to shut the economy means we can thankfully plan a way through all of the noise to the spring and the return of better trading conditions in conjunction with learning to live with the virus which has quickly become a possibility. In our last report we targeted March 2022 as the time when conditions will probably allow a level playing field for growth towards pre-pandemic trading, and despite the chaos created by the Omicron variant, we see no reason to change this timeframe.

Ensuring sales strategies are robust so that a property can exceed its fair market share and not resort to rate dumping is critical, so we have used SiteMinder’s World Hotel Index tool with a continued focus on UK regions and cities to update as follows:

- UK comparison compared to a broad global trajectory, Germany & France, both with similar-sized economy & population and a larger international economy in the United States.

- UK City update with the expected drop in demand following the damage caused by the new variant and media reporting following “Plan B” measures.

So, a simple update of the current UK performance compared to other similar size economies shows we are faring ok, but at just over 76% of 2019 of trading before the pandemic and 1st lockdown, we all appreciate that 25% down on a normal January is gloomy indeed, particularly as cash reserves will be depleted from a difficult festive season.

We have also detailed some initiatives with solutions and partnerships that have been successful in supporting our projects, whilst looking past some of the sensationalised reporting in parts of the media and any misinformation by sticking to what we can control. Separate to revenue growth we cannot either ignore rising inflation and its effect on supply chain and pricing, lack of staffing and skills resources while the Government support is starting to fall away, and no likelihood of anything further coming from no. 11 Downing Street, but we will comment on that separately.

As always, all current booking trends are compared to 2019/20 actuals given this is where we aspire to get back to, as we are all too aware that post-March 2020 and the 1st lockdown doesn’t provide an adequate growth target.

UK compared to the Rest of the World.

Booking Momentum – very broad numbers show the UK roughly 25% down on a normal January demand.

Observations: whilst ahead of some comparable markets this makes for challenging trading, where comparisons to January 2019 show the lack of volume.

UK Cities focus, regional disparity highlights need for location-specific planning

We have seen again how sensitive consumer demand is with the Government and media messaging killing the momentum we were enjoying into the autumn; however, we have also seen that works both ways and the pent up consumer demand will be triggered to return with a bounce once that messaging changes and conditions allow. Particularly last summer in line with the road map, leisure demand led to successful summers for many operators and we have the added incentive in the spring of domestic and international business travellers returning for the first time in earnest for 2 years.

The table below shows that on the 4th of January demand fluctuated between 54% (Glasgow) and 95% in Bristol – this will be driven mainly by differing covid related controls in England and Scotland and a New Year bounce, however, highlights the need for a specific sales recovery plan depending on location and the external factors likely to affect a business into that city or its surrounding region.

Most of these larger cities will be reliant on the return of international travellers to achieve pre-pandemic trading, and we are seeing continued relaxation to allow for that over time – hopefully, the news last week where the travel industry is putting pressure on Government to relax testing regimes for the vaccinated to allow easier travel will have a big positive impact to demand volumes.

Booking Momentum by City - the table below compares daily bookings made as a % of the year 2019/2020, comparing momentum across a section of different UK & international destinations.

Support for your Revenue and Sales strategy

To support getting sales and revenue growth strategies right we have dedicated revenue management and proactive sales resources available on a flexible basis. A member of our team could join the hotel team for as little 4 hours a week which would also have a big impact in reducing payroll costs and removing some of the current challenges of staff shortages.

We have listed below some sales and revenue growth initiatives we are working on, Assured Hotels retain a skilled team of revenue and sales personnel ready to support, advise and implement on agreed activity including:

- Rate strategy review - will current pricing plans deliver the best volume and margin from the local market conditions?

- Distribution review to include: OTA’s, GDS partner and challenge content on own and partner websites.

- Franchise or soft brand support options review.

- Pay per click and key phrase campaign review.

- Database cleanse and campaign content planned and distributed.

- Flash sales and other high impact, strategic campaigns.

This is just an illustration of where Assured Hotels can support sales and revenue teams - if you or a client has a hotel business, we are well placed to give an impartial sense check of rate & distribution strategies for a very low commitment on cost to ensure all opportunities are maximised as the sector recovers, particularly in relation to revenue driving profit forecasts as Government support is removed.

As always, the data used paints a very broad-brush picture, particularly as it only uses daily rooms sold as a macro indicator and does not include rate or therefore revenue analysis. This broader data is also available to us across all UK regions.

Subscribe to our hotel sector updates - click here

Supporting Stakeholders – meet with us on a no-obligation basis.

Please do not hesitate to contact us to discuss finance reporting & forecasting, procurement, sales and revenue management, funding, and Government support.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

Entegra Market Report Autumn 2021

Entegra's quarterly market report highlights general challenges in the food supply chain but from a solution based perspective. Engaging with 3rd party support will assist in identifying where specific changes to produce will help ensure delivery at best price to protect margins, and categories with future risks as we plan for the crucial Christmas period.

Entegra-Market-Report-Autumn-2021

September food market summary from procurement partner Entegra Europe.

This highlights general challenges in the food supply chain and where specific changes to produce will help ensure delivery at best price to protect margins, and categories with future risks for menu planning.

Entegra-Market-Summary-Sept-21

City Centre Case Study

An update to a previous case study shows how sales & marketing initiatives have produced trading growth over the past 3 months. This is relevant to any location where the staycation benefit isn't being felt as strongly, which have still resulted in revenues exceeding budgets from a sharp rise in booking volumes.

AH-CASE-STUDY-PANDEMIC-EXIT-STRATEGY-JUL-21

RECOVERY - Issue 6 - Support Case Studies

Assured Hotels have experiences in many challenging assignments, updated case studies from before and during the pandemic summarise a sample of different appointments and outcomes.