DEMAND REPORT: UK hotels - a light at the end of the tunnel?

We recently wrote an updated demand report published on LinkedIn, where we looked at the UK performance over a difficult winter after the onset of the Omnicron variant. Since this was written the UK has made significant strides towards reopening our economy fully, so we have updated the latest demand trends with particular focus on:

- UK comparison compared to a broad global trajectory, Germany & France, both with similar-sized economy & population and a larger international economy in the United States.

- UK City update, with continued growth towards pre-pandemic occupancies in most UK cities. Further evidence that this has in part been driven by a return of International travellers in the bookings mix.

Accurate forecasting in the quarter ahead into the spring is clearly critical, as expectations of sustained trading growth increase as financial support comes to an end.

Finally, we have set out examples of solutions we can provide to support management teams in making more accurate revenue forecasts to maximise margins and improve cash flow.

The UK compared to the Rest of the World

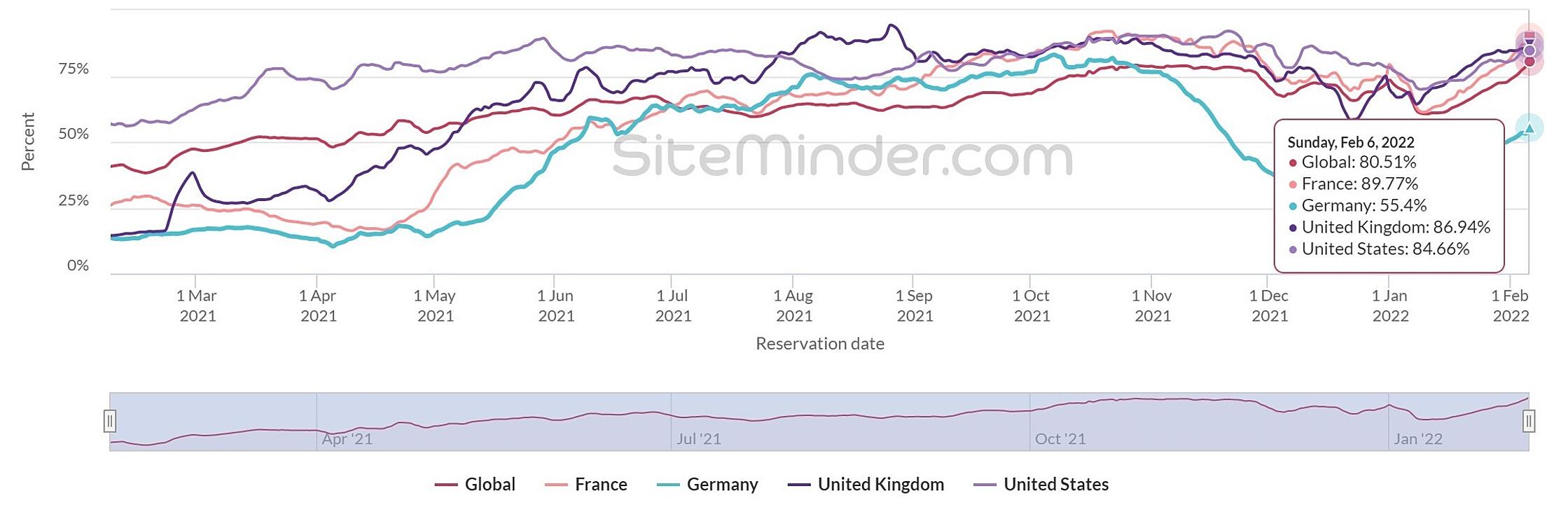

Booking Momentum - table below compares daily bookings made as a % of 2019/20, looking at the UK against the Global consolidated figure and the daily pace in Germany, France & the US.

The UK continues on an upward trajectory, now sitting at just under 87% of pre-pandemic trading, which is a 10% improvement from the start of this year. We can see this compares well with other similar economies.

The UK continues on an upward trajectory, now sitting at just under 87% of pre-pandemic trading, which is a 10% improvement from the start of this year. We can see this compares well with other similar economies.

UK cities focus, growth in International market mix

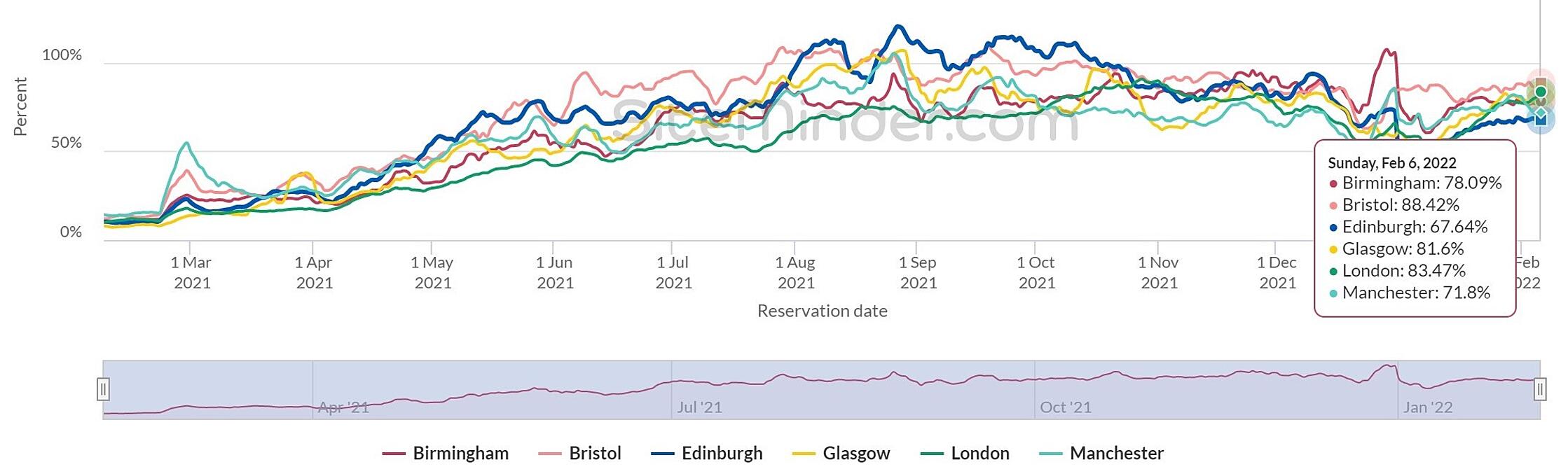

The selection of UK cities below shows the majority of business dominant centres are now sat above 80% of the levels of 2 years ago, with only Manchester going backwards since early January.

Booking Momentum by City - table below compares daily bookings made as a % of 2019/20, comparing momentum across a section of different UK destinations.

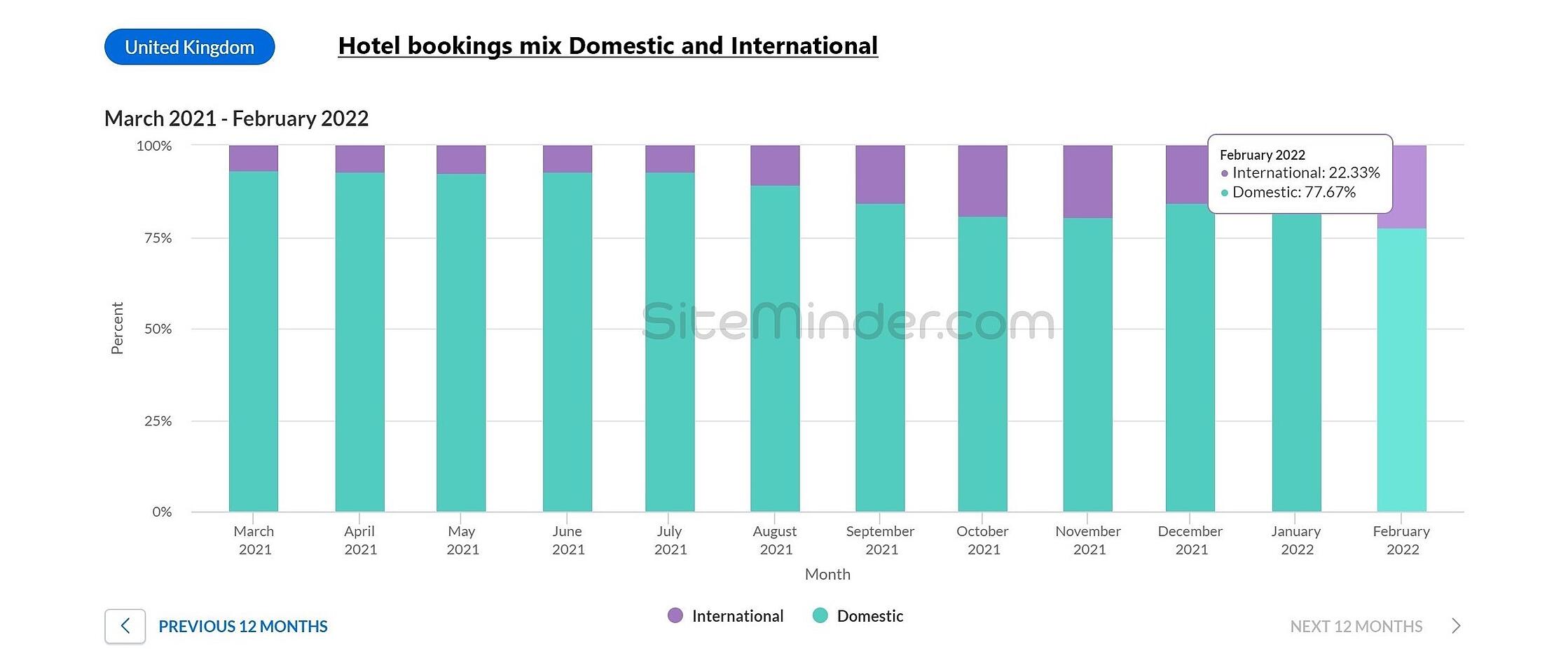

We can see in the second table below that this has been driven by a return of International travellers to these business centres as travel restrictions ease. February 2020 before 1st lockdown International travellers accounted for 23% of hotel stays in the UK, so we are close to that target to date in Feb 2022 with 22.33%.

We can see in the second table below that this has been driven by a return of International travellers to these business centres as travel restrictions ease. February 2020 before 1st lockdown International travellers accounted for 23% of hotel stays in the UK, so we are close to that target to date in Feb 2022 with 22.33%.

Booking Momentum mix - table below compares the mix of UK hotel bookings from Domestic and International sources.

As a mi

As a mi

Forecasting, Revenue Growth and Sales strategies

Sales and revenue strategies to ensure fair market share and accurate forecasting in in the period ahead. We have a team of dedicated revenue management and proactive sales resources available on a flexible basis. A member of our team could join a hotel team for as little as 4 hours a week which would also have the additional benefit of reducing payroll costs and removing some of the current challenges of staff shortages.

Assured Hotels can advise and implement on activity to drive revenue growth including a rate strategy & distribution review, to ensure the optimum rate is available across the right channels.

Sales & marketing initiatives must be planned to maximise exposure, and the past 2 years has thrown up a host of opportunities. As a minimum, we would recommend a review of lapsed corporate & leisure users and the agency connections which were in place before the pandemic - we have a long-standing relationship with a GDS (Global Distribution System) partner HotelREZ to check and challenge crucial connections into corporate and group markets.

Marketing must also be planned, for example, hotel own websites have grown to the 2nd best performing UK distribution channel and therefore must be refreshed and up to date with pay per click and key phrase campaigns. Direct mailing of offers to include family and leisure packages towards what will be another busy staycation from the spring. Using a database cleanse will also help raise awareness to previously regular customers.

This is just an illustration of where Assured Hotels can support sales and revenue teams - if you or a client has a hotel business, we are well placed to give an impartial sense check of all plans for a very low commitment on cost to ensure all opportunities are maximised as the sector recovers, particularly in relation to revenue-driving profit forecasts as Government support is removed.

Return of International traveller drives UK hotel occupancy

Positive hotel occupancy growth trends continue globally and are discussed regionally in this short article, which compares two periods of covid restrictions 2022 to 2021, demonstrating the return of International travel helping to drive UK hotel occupancy.

Assured Hotels January 2022 demand report – New Year solutions for hotel revenue growth out of the pandemic

Since our last demand update report in October and the onset of the new variant, we have experienced the familiar cycle of media-driven hype smashing consumer demand, which in our sector means stagnation and regression of hotel room revenues.

Whilst the worst numbers on infections and pressure on the NHS is probably yet to come, the Government’s stated balanced strategy with no plans to shut the economy means we can thankfully plan a way through all of the noise to the spring and the return of better trading conditions in conjunction with learning to live with the virus which has quickly become a possibility. In our last report we targeted March 2022 as the time when conditions will probably allow a level playing field for growth towards pre-pandemic trading, and despite the chaos created by the Omicron variant, we see no reason to change this timeframe.

Ensuring sales strategies are robust so that a property can exceed its fair market share and not resort to rate dumping is critical, so we have used SiteMinder’s World Hotel Index tool with a continued focus on UK regions and cities to update as follows:

- UK comparison compared to a broad global trajectory, Germany & France, both with similar-sized economy & population and a larger international economy in the United States.

- UK City update with the expected drop in demand following the damage caused by the new variant and media reporting following “Plan B” measures.

So, a simple update of the current UK performance compared to other similar size economies shows we are faring ok, but at just over 76% of 2019 of trading before the pandemic and 1st lockdown, we all appreciate that 25% down on a normal January is gloomy indeed, particularly as cash reserves will be depleted from a difficult festive season.

We have also detailed some initiatives with solutions and partnerships that have been successful in supporting our projects, whilst looking past some of the sensationalised reporting in parts of the media and any misinformation by sticking to what we can control. Separate to revenue growth we cannot either ignore rising inflation and its effect on supply chain and pricing, lack of staffing and skills resources while the Government support is starting to fall away, and no likelihood of anything further coming from no. 11 Downing Street, but we will comment on that separately.

As always, all current booking trends are compared to 2019/20 actuals given this is where we aspire to get back to, as we are all too aware that post-March 2020 and the 1st lockdown doesn’t provide an adequate growth target.

UK compared to the Rest of the World.

Booking Momentum – very broad numbers show the UK roughly 25% down on a normal January demand.

Observations: whilst ahead of some comparable markets this makes for challenging trading, where comparisons to January 2019 show the lack of volume.

UK Cities focus, regional disparity highlights need for location-specific planning

We have seen again how sensitive consumer demand is with the Government and media messaging killing the momentum we were enjoying into the autumn; however, we have also seen that works both ways and the pent up consumer demand will be triggered to return with a bounce once that messaging changes and conditions allow. Particularly last summer in line with the road map, leisure demand led to successful summers for many operators and we have the added incentive in the spring of domestic and international business travellers returning for the first time in earnest for 2 years.

The table below shows that on the 4th of January demand fluctuated between 54% (Glasgow) and 95% in Bristol – this will be driven mainly by differing covid related controls in England and Scotland and a New Year bounce, however, highlights the need for a specific sales recovery plan depending on location and the external factors likely to affect a business into that city or its surrounding region.

Most of these larger cities will be reliant on the return of international travellers to achieve pre-pandemic trading, and we are seeing continued relaxation to allow for that over time – hopefully, the news last week where the travel industry is putting pressure on Government to relax testing regimes for the vaccinated to allow easier travel will have a big positive impact to demand volumes.

Booking Momentum by City - the table below compares daily bookings made as a % of the year 2019/2020, comparing momentum across a section of different UK & international destinations.

Support for your Revenue and Sales strategy

To support getting sales and revenue growth strategies right we have dedicated revenue management and proactive sales resources available on a flexible basis. A member of our team could join the hotel team for as little 4 hours a week which would also have a big impact in reducing payroll costs and removing some of the current challenges of staff shortages.

We have listed below some sales and revenue growth initiatives we are working on, Assured Hotels retain a skilled team of revenue and sales personnel ready to support, advise and implement on agreed activity including:

- Rate strategy review - will current pricing plans deliver the best volume and margin from the local market conditions?

- Distribution review to include: OTA’s, GDS partner and challenge content on own and partner websites.

- Franchise or soft brand support options review.

- Pay per click and key phrase campaign review.

- Database cleanse and campaign content planned and distributed.

- Flash sales and other high impact, strategic campaigns.

This is just an illustration of where Assured Hotels can support sales and revenue teams - if you or a client has a hotel business, we are well placed to give an impartial sense check of rate & distribution strategies for a very low commitment on cost to ensure all opportunities are maximised as the sector recovers, particularly in relation to revenue driving profit forecasts as Government support is removed.

As always, the data used paints a very broad-brush picture, particularly as it only uses daily rooms sold as a macro indicator and does not include rate or therefore revenue analysis. This broader data is also available to us across all UK regions.

Subscribe to our hotel sector updates - click here

Supporting Stakeholders – meet with us on a no-obligation basis.

Please do not hesitate to contact us to discuss finance reporting & forecasting, procurement, sales and revenue management, funding, and Government support.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

Entegra Market Report Autumn 2021

Entegra's quarterly market report highlights general challenges in the food supply chain but from a solution based perspective. Engaging with 3rd party support will assist in identifying where specific changes to produce will help ensure delivery at best price to protect margins, and categories with future risks as we plan for the crucial Christmas period.

Entegra-Market-Report-Autumn-2021

Hotel Sales Demand - September Report

As the weather turns signalling the end of summer and the UK staycation boom now tailing off, we begin the hard work of preparing to sustain sector recovery through a tough winter ahead. Whilst the bigger picture continues to evolve in a positive overall direction for both health and the economy, significant risks remain as we continue to progress out of the pandemic.

September food market summary from procurement partner Entegra Europe.

This highlights general challenges in the food supply chain and where specific changes to produce will help ensure delivery at best price to protect margins, and categories with future risks for menu planning.

Entegra-Market-Summary-Sept-21

Hotel Sales Demand - August Report

Contrary to the traditional summer slowdown our August hotel demand update shows all regional UK cities continuing to bounce back strongly, and quicker than their international contemporaries. Whilst there is still plenty of ground to claw back further confidence can be taken from 3rd party evidence reporting of a "balancing up" in the number of international travellers against domestic on a Global basis. This clearly demonstrates pent up demand in business markets, critical to recovery over the autumn into winter.

A greater balance is forming between domestic and international hotel guests

Unlike this same time last year, we are no longer looking at a world dominated entirely by domestic travel. This month, international trips constituted 44% of all bookings made globally, compared to 33% in August of 2020, highlighting a growing collective confidence, particularly in EMEA and the Americas.

Hotel Sales Demand - July Report

Our analysis shows evidence of urban hotels starting to recover, particularly where domestic leisure contributes to the market mix. However, whilst volumes in the main city and airport locations have improved further progress could be hampered as overseas travel restrictions are only starting to lift slowly, with some locations clearly missing the international visitor spend.

City Centre Case Study

An update to a previous case study shows how sales & marketing initiatives have produced trading growth over the past 3 months. This is relevant to any location where the staycation benefit isn't being felt as strongly, which have still resulted in revenues exceeding budgets from a sharp rise in booking volumes.

AH-CASE-STUDY-PANDEMIC-EXIT-STRATEGY-JUL-21