DEMAND REPORT: UK hotels – a light at the end of the tunnel?

We recently wrote an updated demand report published on LinkedIn, where we looked at the UK performance over a difficult winter after the onset of the Omnicron variant. Since this was written the UK has made significant strides towards reopening our economy fully, so we have updated the latest demand trends with particular focus on:

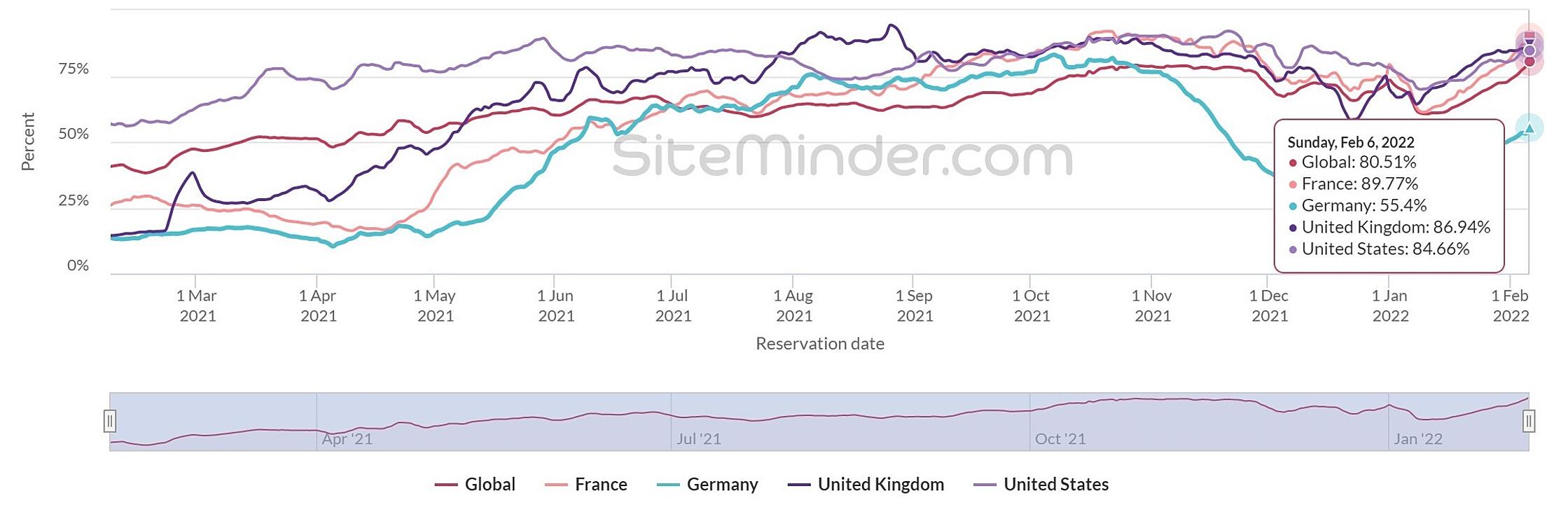

- UK comparison compared to a broad global trajectory, Germany & France, both with similar-sized economy & population and a larger international economy in the United States.

- UK City update, with continued growth towards pre-pandemic occupancies in most UK cities. Further evidence that this has in part been driven by a return of International travellers in the bookings mix.

Accurate forecasting in the quarter ahead into the spring is clearly critical, as expectations of sustained trading growth increase as financial support comes to an end.

Finally, we have set out examples of solutions we can provide to support management teams in making more accurate revenue forecasts to maximise margins and improve cash flow.

The UK compared to the Rest of the World

Booking Momentum – table below compares daily bookings made as a % of 2019/20, looking at the UK against the Global consolidated figure and the daily pace in Germany, France & the US.

The UK continues on an upward trajectory, now sitting at just under 87% of pre-pandemic trading, which is a 10% improvement from the start of this year. We can see this compares well with other similar economies.

The UK continues on an upward trajectory, now sitting at just under 87% of pre-pandemic trading, which is a 10% improvement from the start of this year. We can see this compares well with other similar economies.

UK cities focus, growth in International market mix

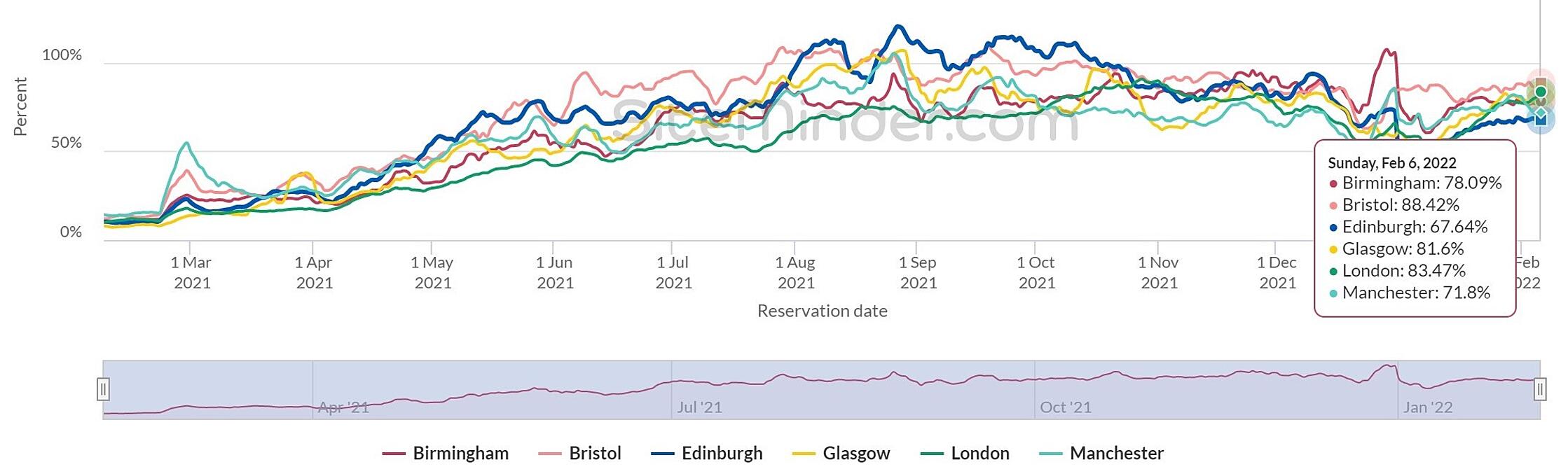

The selection of UK cities below shows the majority of business dominant centres are now sat above 80% of the levels of 2 years ago, with only Manchester going backwards since early January.

Booking Momentum by City – table below compares daily bookings made as a % of 2019/20, comparing momentum across a section of different UK destinations.

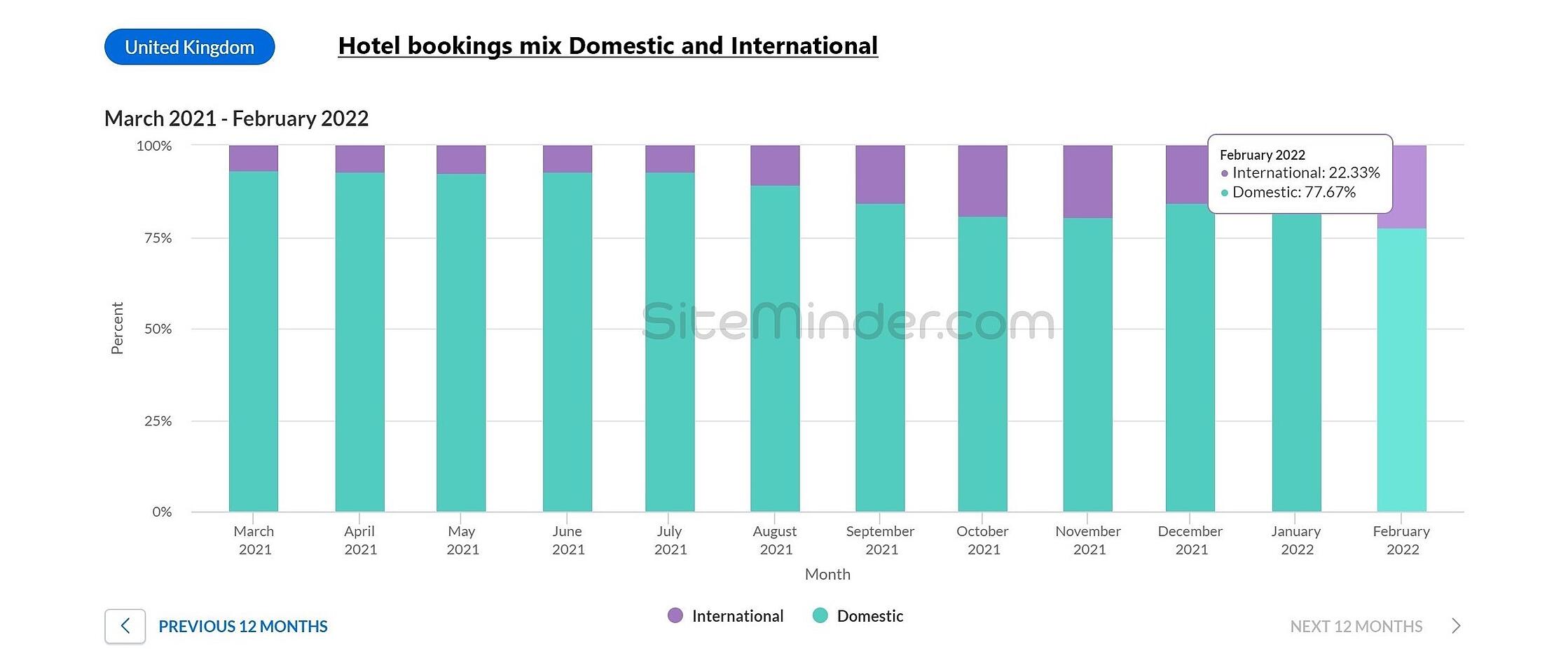

We can see in the second table below that this has been driven by a return of International travellers to these business centres as travel restrictions ease. February 2020 before 1st lockdown International travellers accounted for 23% of hotel stays in the UK, so we are close to that target to date in Feb 2022 with 22.33%.

We can see in the second table below that this has been driven by a return of International travellers to these business centres as travel restrictions ease. February 2020 before 1st lockdown International travellers accounted for 23% of hotel stays in the UK, so we are close to that target to date in Feb 2022 with 22.33%.

Booking Momentum mix – table below compares the mix of UK hotel bookings from Domestic and International sources.

As a mi

As a mi

Forecasting, Revenue Growth and Sales strategies

Sales and revenue strategies to ensure fair market share and accurate forecasting in in the period ahead. We have a team of dedicated revenue management and proactive sales resources available on a flexible basis. A member of our team could join a hotel team for as little as 4 hours a week which would also have the additional benefit of reducing payroll costs and removing some of the current challenges of staff shortages.

Assured Hotels can advise and implement on activity to drive revenue growth including a rate strategy & distribution review, to ensure the optimum rate is available across the right channels.

Sales & marketing initiatives must be planned to maximise exposure, and the past 2 years has thrown up a host of opportunities. As a minimum, we would recommend a review of lapsed corporate & leisure users and the agency connections which were in place before the pandemic – we have a long-standing relationship with a GDS (Global Distribution System) partner HotelREZ to check and challenge crucial connections into corporate and group markets.

Marketing must also be planned, for example, hotel own websites have grown to the 2nd best performing UK distribution channel and therefore must be refreshed and up to date with pay per click and key phrase campaigns. Direct mailing of offers to include family and leisure packages towards what will be another busy staycation from the spring. Using a database cleanse will also help raise awareness to previously regular customers.

This is just an illustration of where Assured Hotels can support sales and revenue teams – if you or a client has a hotel business, we are well placed to give an impartial sense check of all plans for a very low commitment on cost to ensure all opportunities are maximised as the sector recovers, particularly in relation to revenue-driving profit forecasts as Government support is removed.