HOTEL DEMAND REPORT: Strong 2022, hotel recovery falters

Hotel demand and revenues have been strong in 2022, with an unexpected but welcome return to 2019 levels. Unfortunately, the UK hotel recovery falters in December, finishing the year with uncertainty on top of inflationary pressures and labour concerns.

The UK hospitality industry has weathered the pandemic years well. Despite the forecasted media doom, a steady diet of central support and peaks in demand has left the majority in reasonably good order. Softening revenues at this point is bad timing, combined with cost pressures will present very different challenges. Clearly, businesses will have to fend for themselves much more than during the pandemic years.

Rising costs and overheads, together with labour shortages causing salary increases on top of lockdown legacy issues not addressed, are all putting unprecedented pressure on margins and cash flow. Assured Hotels have continued to offer insight and how-to guides in a series of blogs on our website. We have championed solutions and support, either interpreting central Government initiatives or from our own skill set and resources or our partner networks.

Strong 2022, hotel recovery falters at the last

Hotel demand in the UK grew back quickly to pre-pandemic levels since the start of 2022, with RevPAR generally better than in 2019. Rooms revenue would therefore suggest that hotel performance and length of recovery, in general, has been nowhere near as bad as was forecast. Unfortunately, this strong recovery in 2022 faltered in December, which we have looked at in more detail below.

UK compared to the Rest of the World

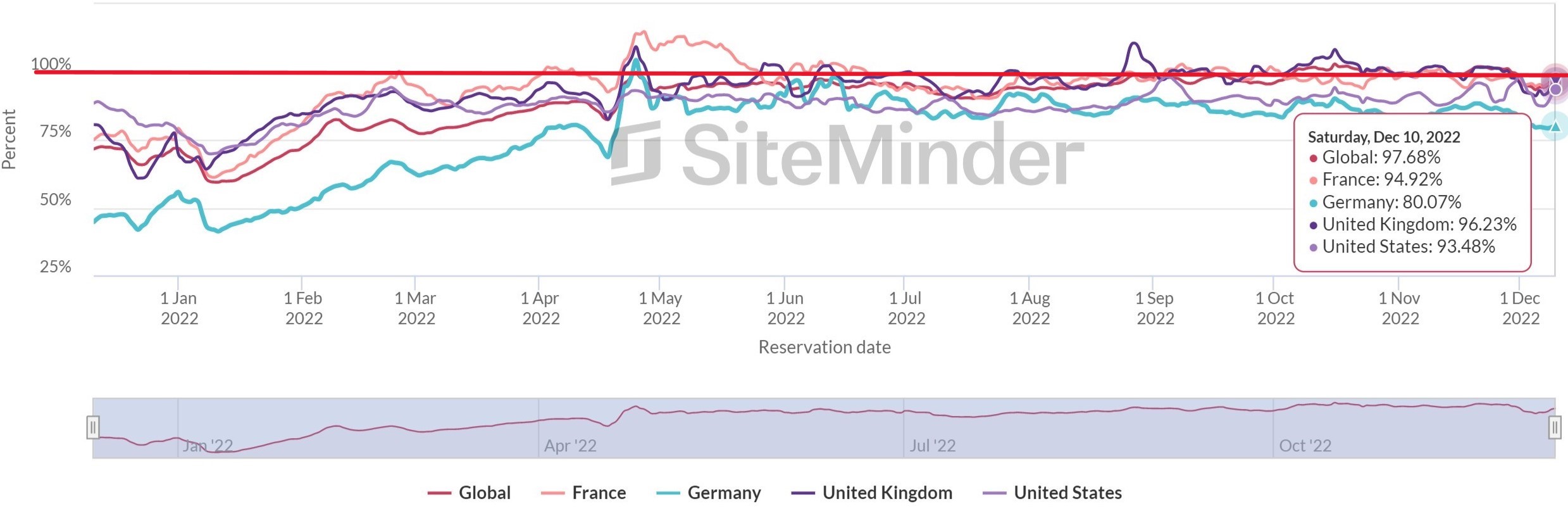

Booking Momentum - table below compares daily bookings made as a % of 2019 (red line), looking at the UK against the Global consolidated figure and selected developed economies.

Observations to the 10th Dec include:

Governments change to advice in early 2022, UK overtook and stayed ahead of the Global pace. This led to a spike in May from pent-up demand but was flat over the summer. The UK saw a better recovery compared to Germany, and now performing better than France & US overall.

However a definite softening to demand in December with the UK below 2019 for the first sustained period in 2022. Additionally, this is a very broad national view, we have also looked at the winners and losers in a regional analysis.

UK cities focus; regional disparity with the majority back on 2019

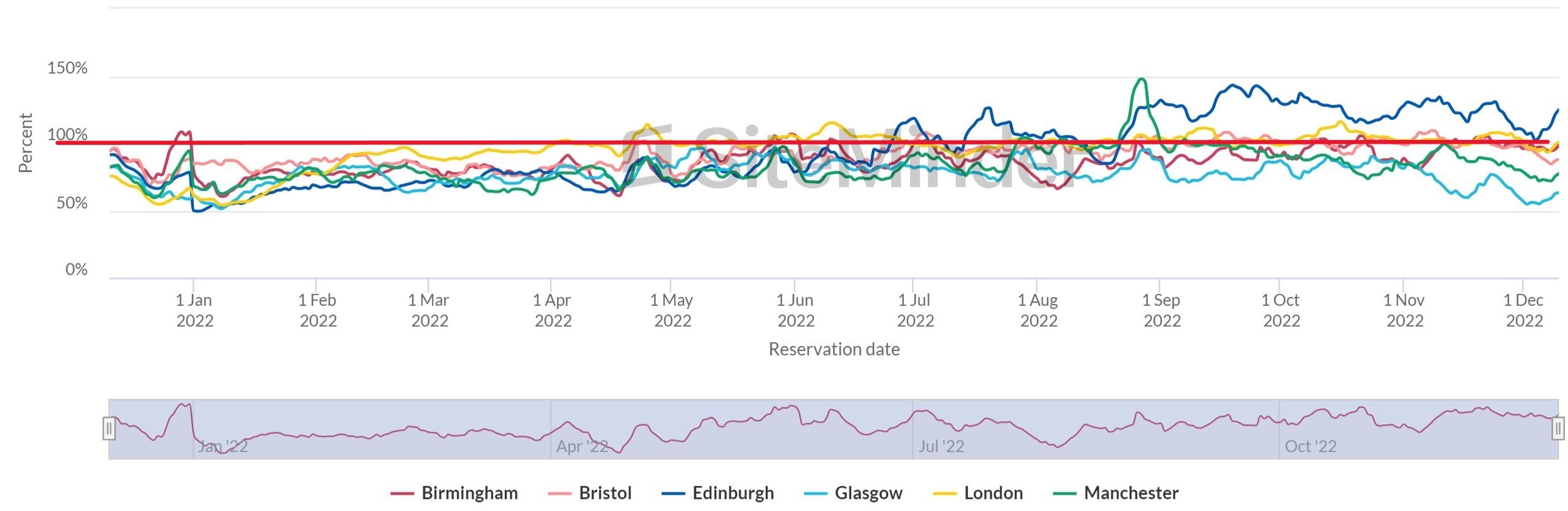

Booking Momentum, regional discrepancies -the table below compares daily bookings made as a % of 2019 (red line), looking at selected cities across the UK.

Observations include:

International destinations like Edinburgh & London continue to perform well, driven by pent-up overseas demand - over 30% of all UK hotels booked since April from overseas markets, traditionally under 15% (2020 under 10%). Leisure particularly coastal destinations reliant on domestic markets had an indifferent summer.

Business-reliant cities down on 2019, could be due to working from home and other behaviour changes. Or an indicator of a permanent drop in business mix.

Overall hotel recovery falters as we end the year causing concern to both revenues and margins. A double edge of cost-of-living pressures, hitting not only margins but also discretionary leisure spending.

Softening demand and inflation - Hotel sector the "canary in the mine"?

In summary, we can see the overall trend is a softening to demand, post-Christmas this is poor timing. Positively other data sources suggest room pricing is holding up. On a local level that will need to be assessed carefully as could also quickly come under pressure. Particularly if individual businesses are behind their competitor set, and simply not able to be so bullish on price.

In previous recessions, the hotel sector was always first to see the downturn, the canary in the mine. Revenue and margin regression at the same time as increasing costs means it is then inevitable that the hotel recovery falters. However, this is not terminal as 3rd party support will bring fresh ideas, motivation and improved performance.

Help is at hand.

Assured Hotels offer specialist support to hotel owners and stakeholders, especially in Hotel Advisory and Asset Management capacities. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

Please click here to book a meeting, email info@assuredhotels.co.uk or call 0203 916 5658.