HOTEL DEMAND REPORT: Strong 2022, hotel recovery falters

Hotel demand and revenues have been strong in 2022, with an unexpected but welcome return to 2019 levels. Unfortunately, the UK hotel recovery falters in December, finishing the year with uncertainty on top of inflationary pressures and labour concerns.

The UK hospitality industry has weathered the pandemic years well. Despite the forecasted media doom, a steady diet of central support and peaks in demand has left the majority in reasonably good order. Softening revenues at this point is bad timing, combined with cost pressures will present very different challenges. Clearly, businesses will have to fend for themselves much more than during the pandemic years.

Rising costs and overheads, together with labour shortages causing salary increases on top of lockdown legacy issues not addressed, are all putting unprecedented pressure on margins and cash flow. Assured Hotels have continued to offer insight and how-to guides in a series of blogs on our website. We have championed solutions and support, either interpreting central Government initiatives or from our own skill set and resources or our partner networks.

Strong 2022, hotel recovery falters at the last

Hotel demand in the UK grew back quickly to pre-pandemic levels since the start of 2022, with RevPAR generally better than in 2019. Rooms revenue would therefore suggest that hotel performance and length of recovery, in general, has been nowhere near as bad as was forecast. Unfortunately, this strong recovery in 2022 faltered in December, which we have looked at in more detail below.

UK compared to the Rest of the World

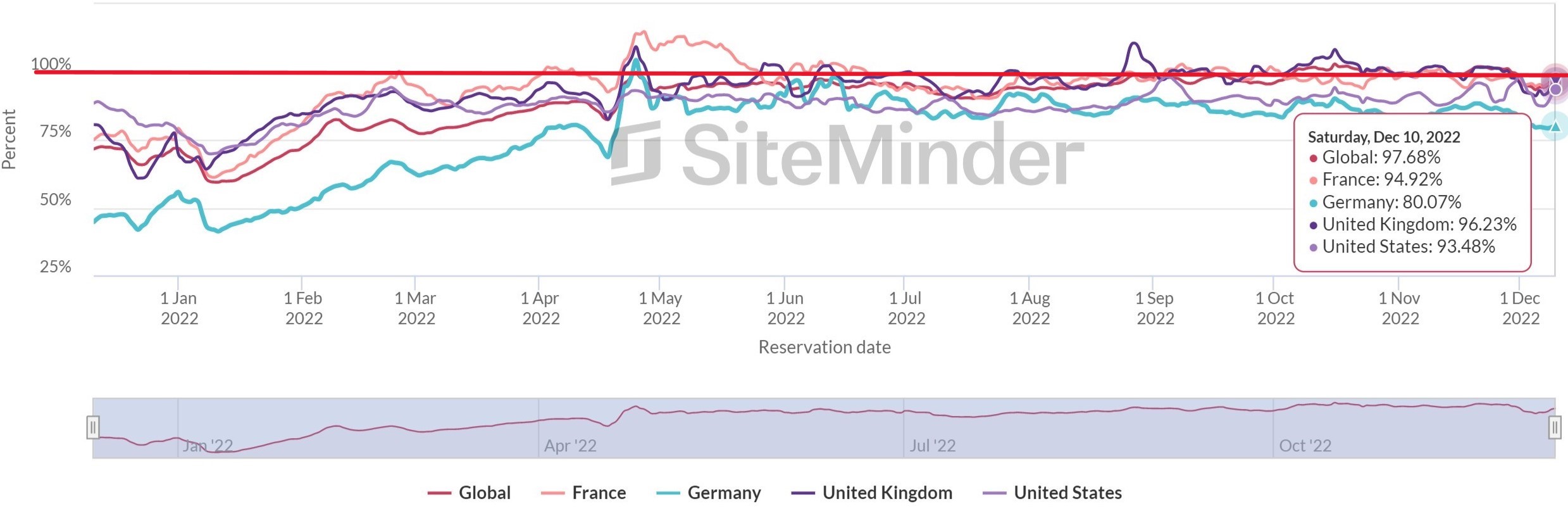

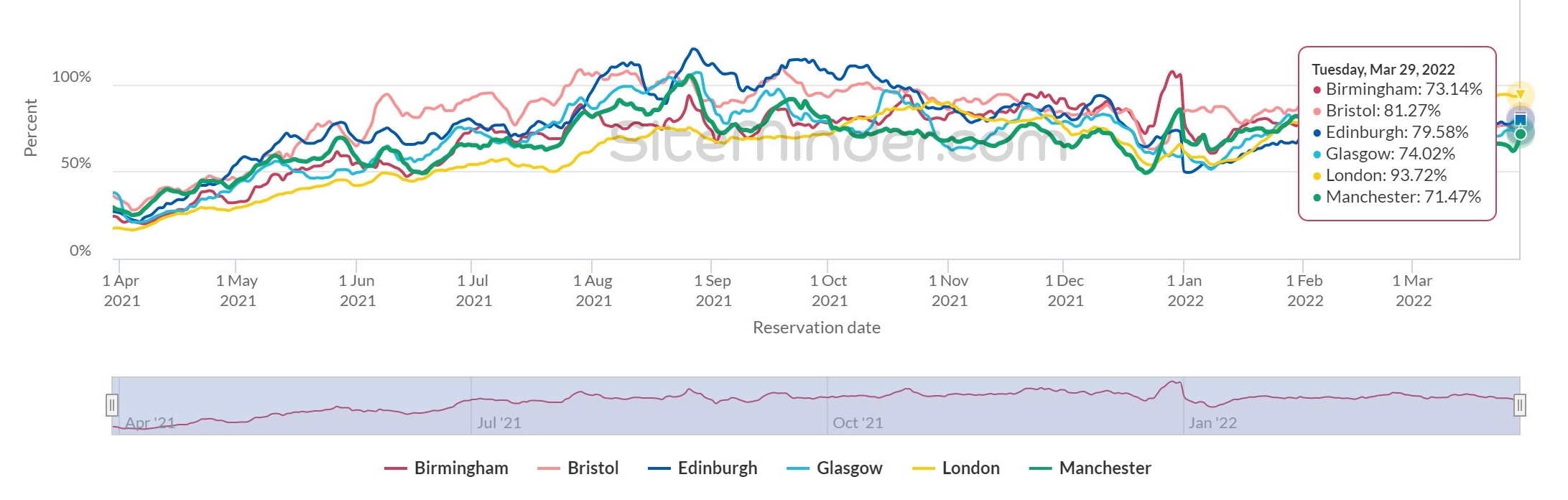

Booking Momentum - table below compares daily bookings made as a % of 2019 (red line), looking at the UK against the Global consolidated figure and selected developed economies.

Observations to the 10th Dec include:

Governments change to advice in early 2022, UK overtook and stayed ahead of the Global pace. This led to a spike in May from pent-up demand but was flat over the summer. The UK saw a better recovery compared to Germany, and now performing better than France & US overall.

However a definite softening to demand in December with the UK below 2019 for the first sustained period in 2022. Additionally, this is a very broad national view, we have also looked at the winners and losers in a regional analysis.

UK cities focus; regional disparity with the majority back on 2019

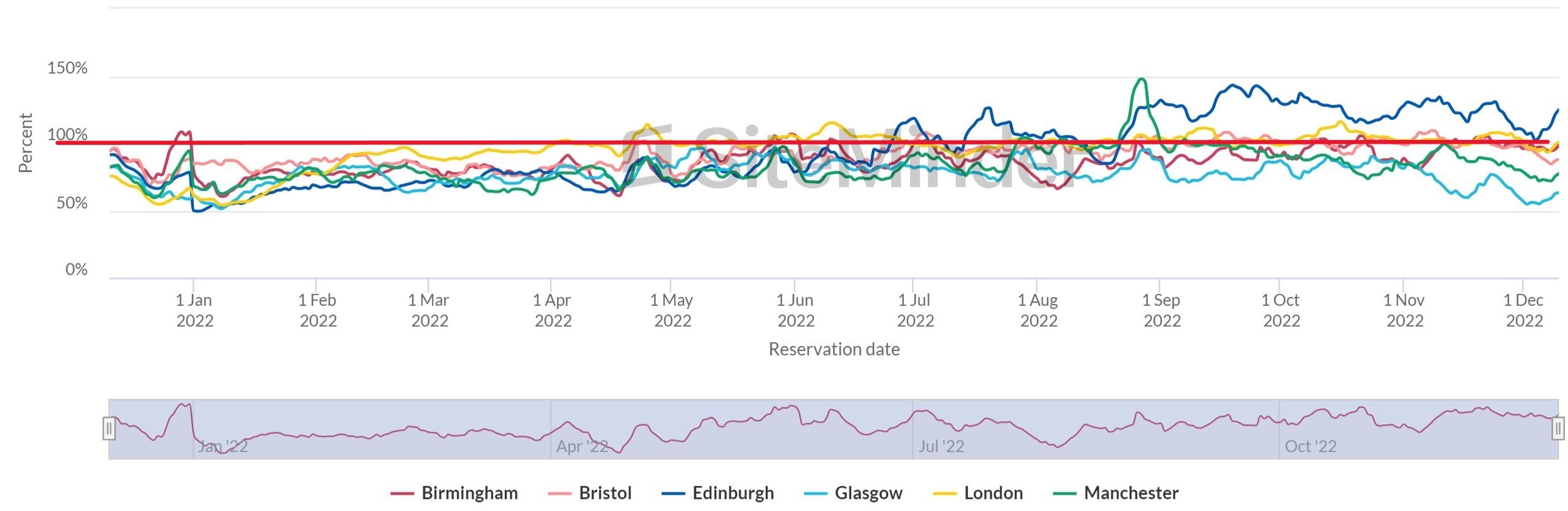

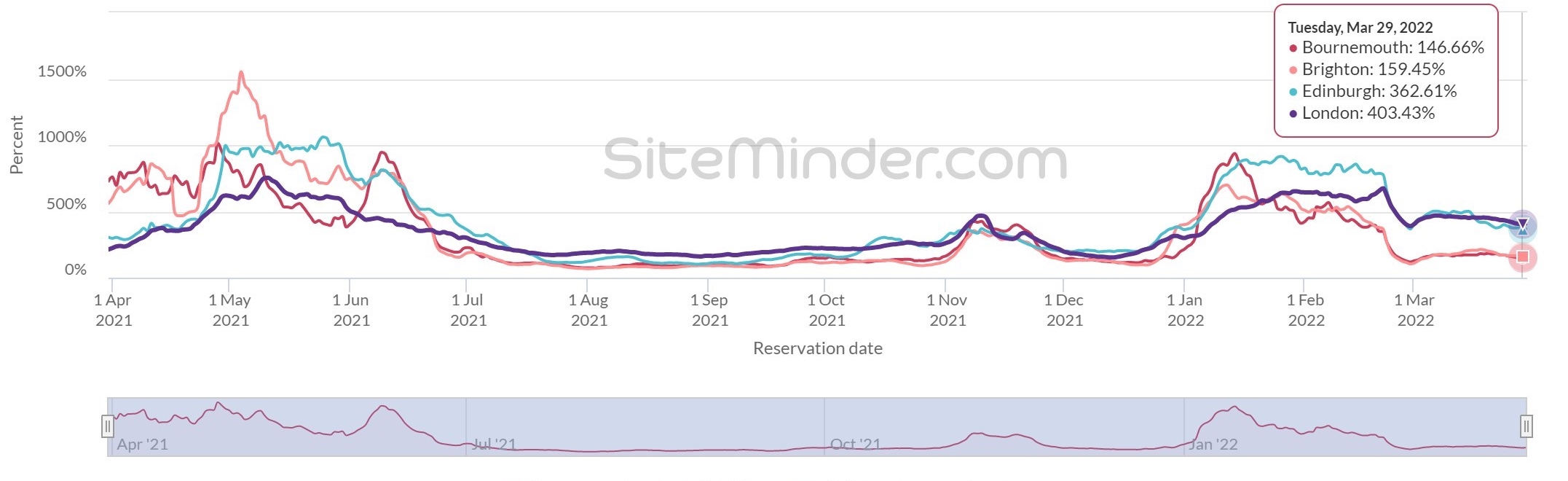

Booking Momentum, regional discrepancies -the table below compares daily bookings made as a % of 2019 (red line), looking at selected cities across the UK.

Observations include:

International destinations like Edinburgh & London continue to perform well, driven by pent-up overseas demand - over 30% of all UK hotels booked since April from overseas markets, traditionally under 15% (2020 under 10%). Leisure particularly coastal destinations reliant on domestic markets had an indifferent summer.

Business-reliant cities down on 2019, could be due to working from home and other behaviour changes. Or an indicator of a permanent drop in business mix.

Overall hotel recovery falters as we end the year causing concern to both revenues and margins. A double edge of cost-of-living pressures, hitting not only margins but also discretionary leisure spending.

Softening demand and inflation - Hotel sector the "canary in the mine"?

In summary, we can see the overall trend is a softening to demand, post-Christmas this is poor timing. Positively other data sources suggest room pricing is holding up. On a local level that will need to be assessed carefully as could also quickly come under pressure. Particularly if individual businesses are behind their competitor set, and simply not able to be so bullish on price.

In previous recessions, the hotel sector was always first to see the downturn, the canary in the mine. Revenue and margin regression at the same time as increasing costs means it is then inevitable that the hotel recovery falters. However, this is not terminal as 3rd party support will bring fresh ideas, motivation and improved performance.

Help is at hand.

Assured Hotels offer specialist support to hotel owners and stakeholders, especially in Hotel Advisory and Asset Management capacities. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

Please click here to book a meeting, email info@assuredhotels.co.uk or call 0203 916 5658.

Hotel sector occupancy demand report

Flat staycation and rising costs, compounded by an economy in decline.

Welcome to Assured Hotels sector insights blog for the Autumn Winter 2022/23, and we kick off with an updated hotel sector occupancy demand report. We have plenty of other scope with the cost of living crisis and inflation. Additionally, a new PM and cabinet to follow, a certain recession deeper and longer than the last and of course, covid legacy issues yet to be addressed.

We will as always view the glass as half full to identify opportunities, providing insight and live data towards informed decisions and meaningful solutions. So since we updated the report before the summer season, the UK hotel sector hasn’t enjoyed buoyant or expected occupancy levels. This is particularly when compared to covid-affected shorter seasons in 2020 and 2021. Data does suggest that most locations have bounced back towards 2019 levels, however, have we banked enough? The biggest challenge to margins is the risks posed by spiralling costs and the impact on revenues in the months ahead.

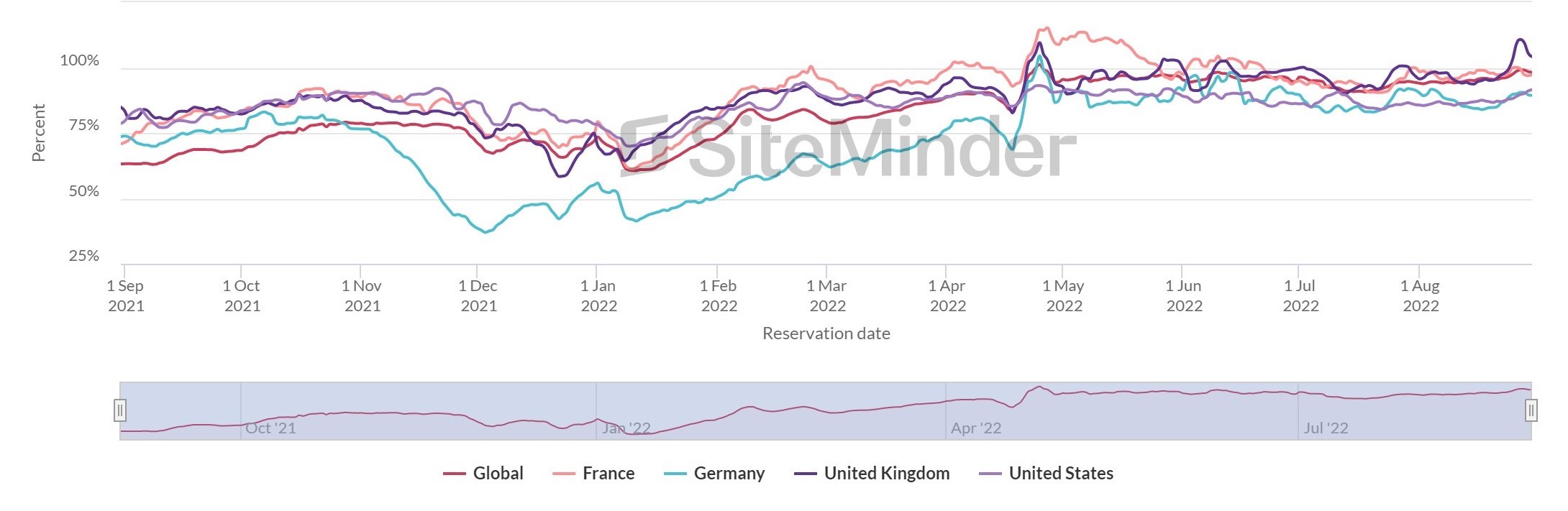

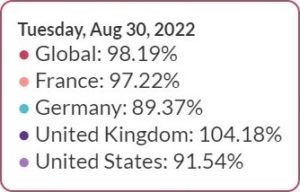

The latest trends show the UK continuing to fare well overall using SiteMinder’s World Hotel Index tool:

- UK comparison to a global trajectory and other economies, all largely back towards 2019 volumes however lacking the summer “peak”.

- UK Cities and regions with an international draw buoyed by strong levels of pent-up demand from overseas travellers.

- Uncertain levels of business activity, during the critical autumn, leading up to Christmas.

The next forecast period looks at risk, the economy in reverse will hit consumer and business spending whilst inflation will impact cost of sales, overheads and margins.

UK occupancy compared to the Rest of the World

Booking Momentum – very broad numbers show the UK roughly back to 2019 but disappointingly flat across the peak season

Observations from the summer season to Friday 26th August:

- Governments change to advice in early 2022, UK's daily pace overtook and stayed ahead of the Global demand.

- Bounce in May from pent-up demand but softened since – the reverse of expected seasonal growth with no peak.

- Better bounce than Germany, with a slightly larger population, similarly strong domestic business market but with less leisure. Now also performing better than France & US overall.

- However, this is a very broad one-dimensional view. Further skewed by lots of hotels still closed or used for other purposes, with winners and losers regionally and locally.

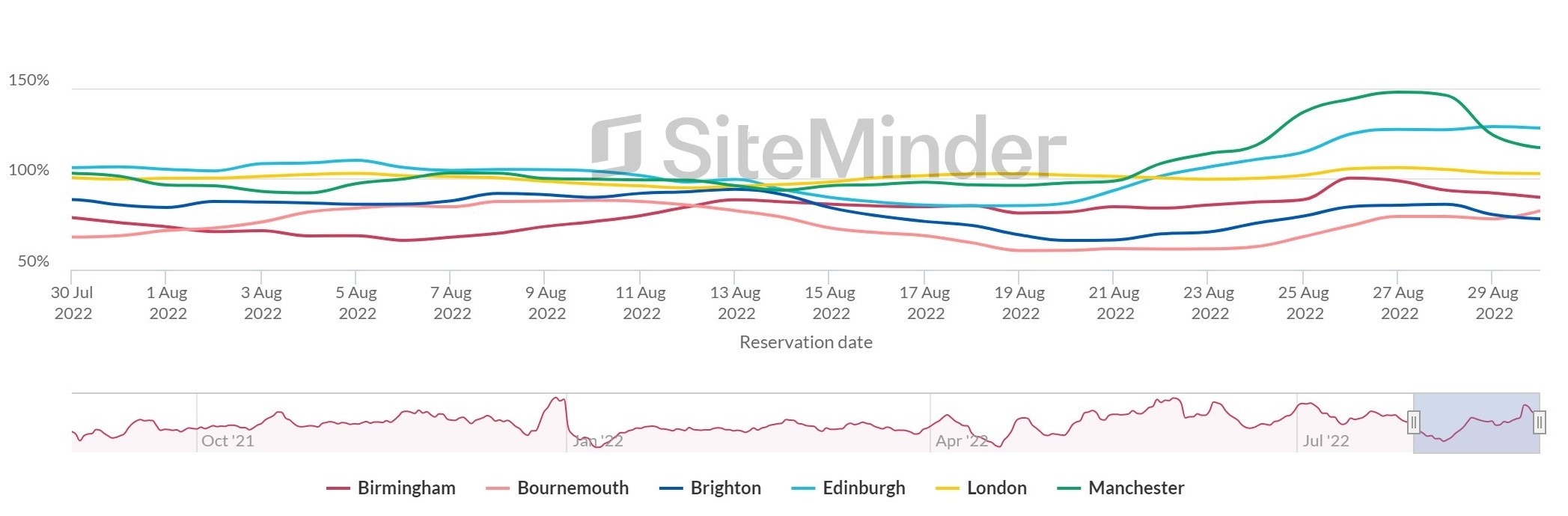

UK Hotel sector occupancy, regional disparity continues

Booking Momentum by City - the table below compares daily bookings made as a % of 2019 volumes, comparing momentum across a section of different UK destinations.

Observations: a mixed bag across different regions, Cities with international appeal perform better:

- London and Edinburgh have performed well over the summer driven by pent-up demand from international travel. This will level out as summer ends, will the business traveller volumes return?

- 34% of all UK hotels booked in June were overseas visitors, 31% in July (in 2020 11.7% & 8.5% respectively). International volumes between 5 & 8% up on 2019.

- Regional cities are mostly still behind 2019, even Birmingham only 80% of 2019 during Commonwealth Games.

- Leisure, particularly coastal destinations have struggled, particularly when compared to strong staycations in 2020/ 21. Brighton circa 70% and Bournemouth only 60% of 2019 during high season weeks. Last-minute staycation cancellations are likely a factor, with a good volume of Brits preferring to go abroad.

- Demand now tailing off as the summer holidays draw to a close, will the business markets return in the numbers required?

Inflation pressures hitting revenues and margins

There is no denying that spiralling inflation is now the biggest threat but not just on cost increases. This will hit hotel spending from consumer and business markets, creating a double attack on margins. This is at a time when many businesses were still grappling with increased borrowing and deferred liabilities from 2020/21. Forecasts will therefore need to be accurate and growth actions more creative than ever.

Despite the gloom and doom, there is still plenty of opportunities to mitigate these risks. So in the coming months, we will be issuing insights and support solutions as the hotel and wider hospitality sector start to navigate this critical phase into a very difficult 2023.

Welcome to Assured Hotels

Assured Hotels have launched a new website detailing how we offer specialist support to hotel owners and stakeholders, in Hotel Advisory and Asset Management capacities. We have been engaged in hotel turnaround and restructuring, trading insolvent businesses and the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, emphasising the development of the hotel's senior management team and therefore better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

DEMAND REPORT: Hotel occupancy recovery continues, while profit risks deepen

March/ April 2022

Since our last demand update report in February, the UK hotel sector has enjoyed consistent occupancy and revenue growth as Q1 draws to a close. However, since that time the world has faced an equal threat to covid, and our recovery is now exposed to different risks, mostly related to protecting profit margins.

Firstly, an update of the current UK performance compared to other similar size economies shows we are continuing to fare well using SiteMinder’s World Hotel Index tool:

- UK is tracking 10% behind March 2020 occupancy, good news if we look back to the opposite end of the graphic and where we were in April ’21.

- UK Cities achieved mixed progress across the regions, London buoyed by a strong return of international travellers.

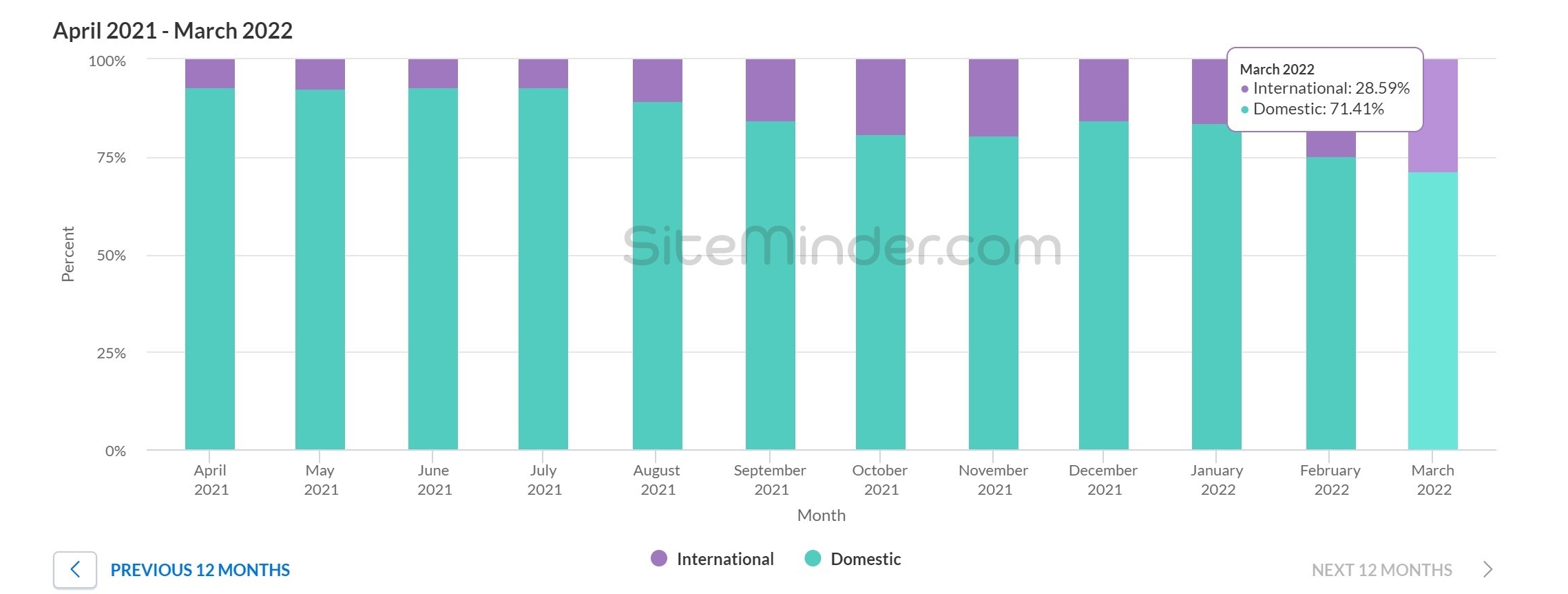

- Booking momentum mix, with international travellers making up a third of UK hotel bookings currently at 28.6%, March 2020 as the lockdown started this was less than 20%.

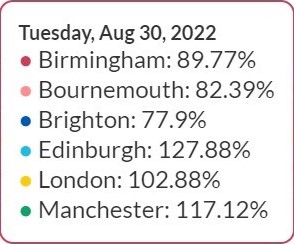

UK compared to the Rest of the World.

Booking Momentum – broad numbers show the UK only 10% down on traditional spring demand

Observations: in isolation this suggests a strong recovery getting towards pre-covid occupancies, however we need to factor other risks to get a full picture for forecasts into Q2 and beyond.

Observations: in isolation this suggests a strong recovery getting towards pre-covid occupancies, however we need to factor other risks to get a full picture for forecasts into Q2 and beyond.

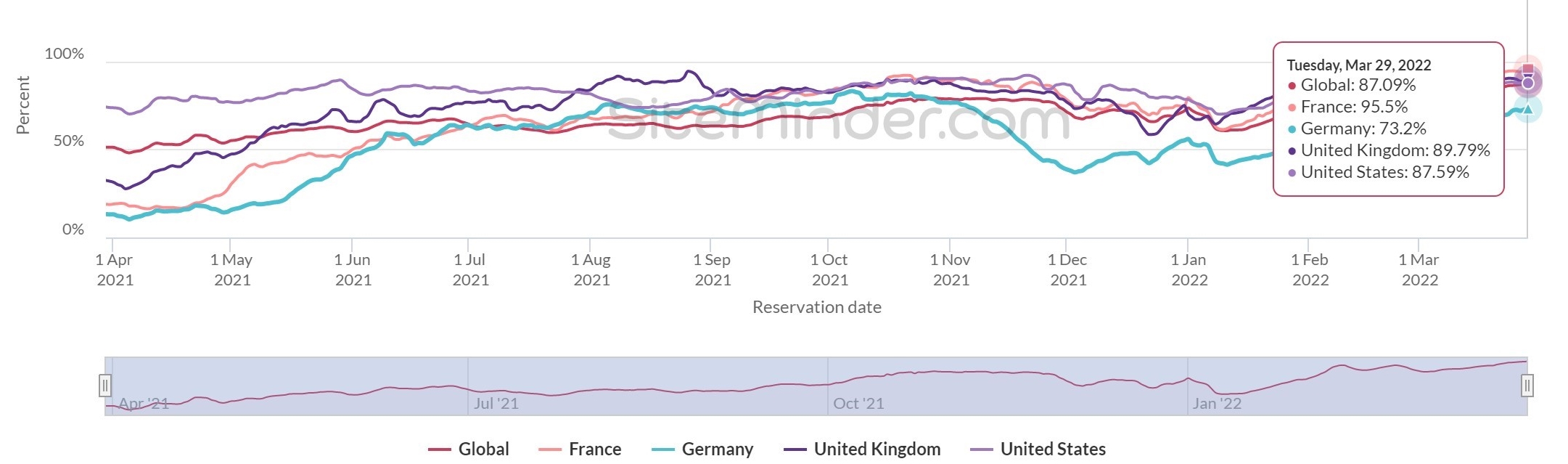

UK cities focus, regional disparity continues

Booking Momentum by City - table below compares daily bookings made as a % of year prior, comparing momentum across a section of different UK destinations.

Observations: a mixed bag across different regions, with London leading the pack for the first time, no doubt as a direct result of returning international travel – see below.

Strong return of international travel

Booking Momentum mix - table below compares the mix of UK hotel bookings from domestic and international sources, March 2022 almost 30% of UK hotel bookings when March 2020 was under 20%.

Observations: as we have seen previously as restrictions lift pent up demand is driving higher levels of international travellers, will this sustain for forecasts as we move into the better weather?

So the general trends point to a sustained recovery with volumes growing back towards 2019/20 levels, which is consistent with other data sources, for example, if we look at this article from Hospitality Net with a specific focus on Europe and what looks like very little effect from the situation in Ukraine.

Profit margins at risk

However, there are now other factors to consider as big risks when looking at Q2 forecasts, including:

- Hotel’s re-opening or returning from alternative use – data sets do not include all closed hotels or those used for temporary alternative uses over the past 24 months, businesses must look locally to see if this will dilute expected market share.

- Staycation 2022 we doubt will live up to 2020 and 2021 now restrictions on air travel have been removed. An early indication is Brighton and Bournemouth in the graphic below, these locations were leading the UK occupancy last year but trends are reversed in 2022.

- Labour shortages continue to limit capacities and increase salary costs just to retain teams and standstill. Additionally, National Minimum wage is set to increase on 1st April which equates to a 6.6% rise across the board if the gap between entry-level employees and supervisory/ junior management is to be retained.

- Covid arrears and forbearance end – the long list of accrued liabilities and arrears will now come into view, including, unpaid taxes to HMRC, unpaid creditors as the moratorium on insolvency ends 31st March, and forbearance on probably higher levels of borrowing and senior debt all need to be addressed.

- Supply pricing – the situation in Eastern Europe has exacerbated winter inflationary pressures, particularly food and general cost of sales items, utilities and fuel which impacts all cost and overhead lines.

- Forecasts therefore will not be straightforward, with capacities and demand uncertain alongside high inflation we are suggesting a need to re-evaluate financial drivers to establish new baseline norms and fully review operational structures and processes.

Assured Hotels have just launched a new website detailing how we offer specialist support to hotel owners and stakeholders, in both Hotel Advisory and Asset Management capacities. We have been engaged in hotel turnaround and restructuring, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of our clients.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines – sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with emphasis on the development of the hotel’s senior management team and therefore better returns for investors and stakeholders.