Hotel sector occupancy demand report

Flat staycation and rising costs, compounded by an economy in decline.

Welcome to Assured Hotels sector insights blog for the Autumn Winter 2022/23, and we kick off with an updated hotel sector occupancy demand report. We have plenty of other scope with the cost of living crisis and inflation. Additionally, a new PM and cabinet to follow, a certain recession deeper and longer than the last and of course, covid legacy issues yet to be addressed.

We will as always view the glass as half full to identify opportunities, providing insight and live data towards informed decisions and meaningful solutions. So since we updated the report before the summer season, the UK hotel sector hasn’t enjoyed buoyant or expected occupancy levels. This is particularly when compared to covid-affected shorter seasons in 2020 and 2021. Data does suggest that most locations have bounced back towards 2019 levels, however, have we banked enough? The biggest challenge to margins is the risks posed by spiralling costs and the impact on revenues in the months ahead.

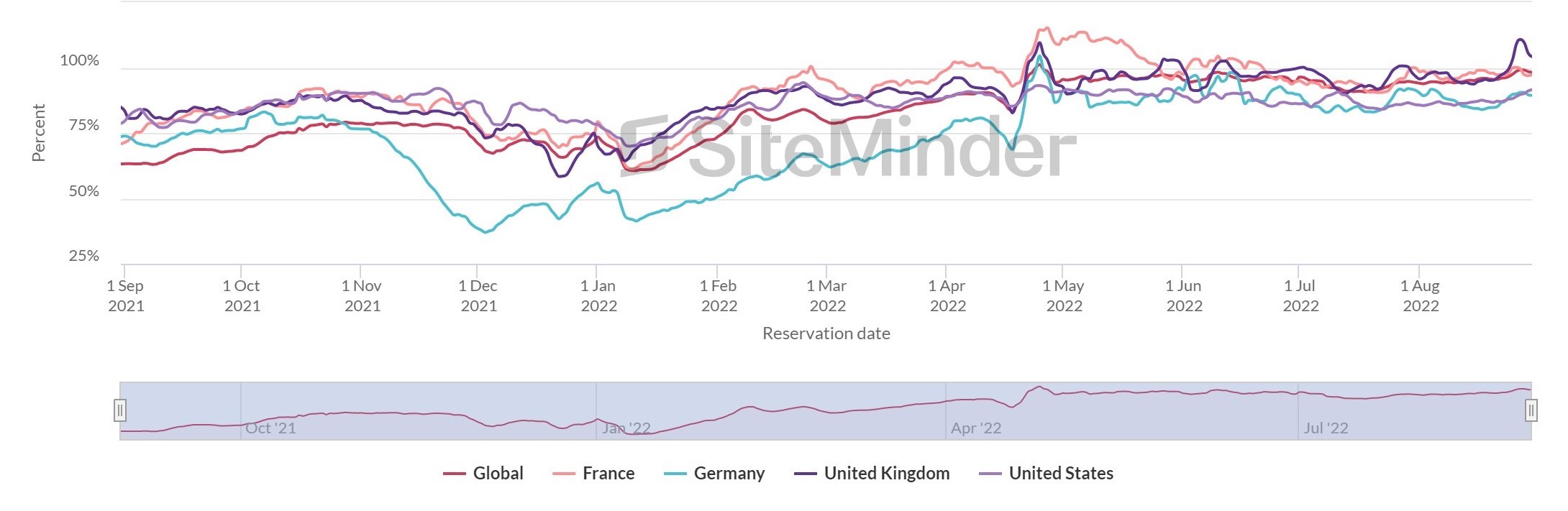

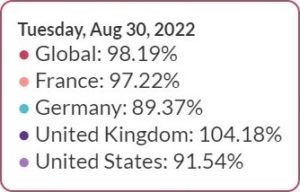

The latest trends show the UK continuing to fare well overall using SiteMinder’s World Hotel Index tool:

- UK comparison to a global trajectory and other economies, all largely back towards 2019 volumes however lacking the summer “peak”.

- UK Cities and regions with an international draw buoyed by strong levels of pent-up demand from overseas travellers.

- Uncertain levels of business activity, during the critical autumn, leading up to Christmas.

The next forecast period looks at risk, the economy in reverse will hit consumer and business spending whilst inflation will impact cost of sales, overheads and margins.

UK occupancy compared to the Rest of the World

Booking Momentum – very broad numbers show the UK roughly back to 2019 but disappointingly flat across the peak season

Observations from the summer season to Friday 26th August:

- Governments change to advice in early 2022, UK’s daily pace overtook and stayed ahead of the Global demand.

- Bounce in May from pent-up demand but softened since – the reverse of expected seasonal growth with no peak.

- Better bounce than Germany, with a slightly larger population, similarly strong domestic business market but with less leisure. Now also performing better than France & US overall.

- However, this is a very broad one-dimensional view. Further skewed by lots of hotels still closed or used for other purposes, with winners and losers regionally and locally.

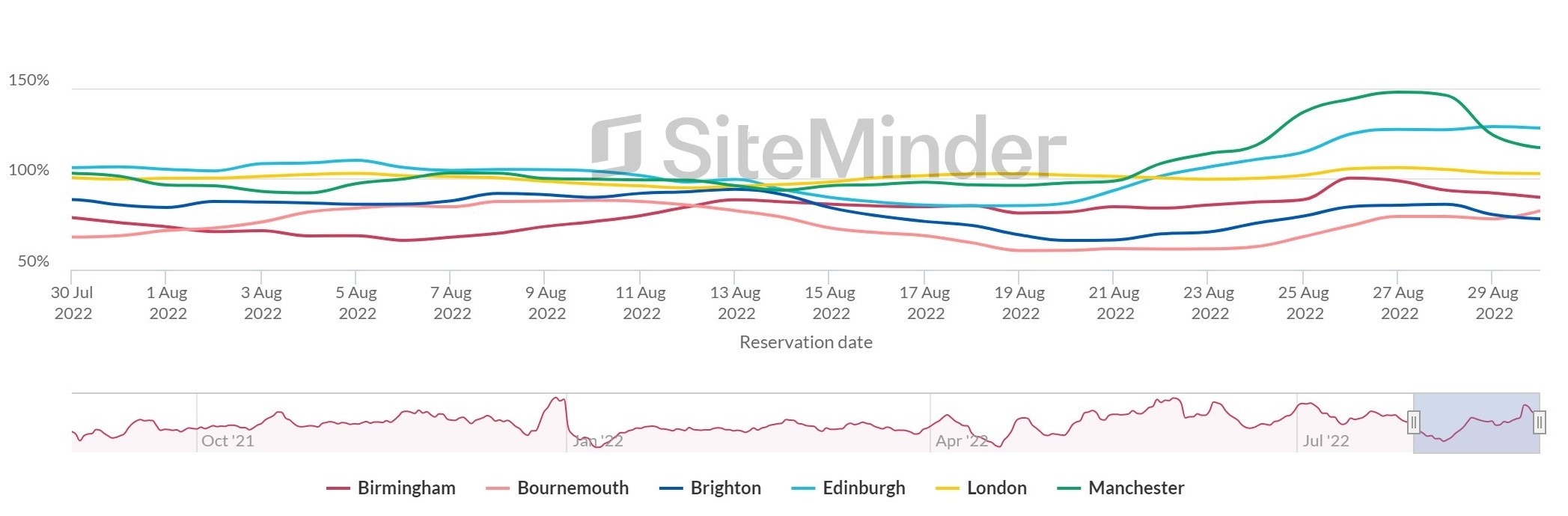

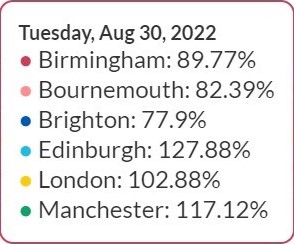

UK Hotel sector occupancy, regional disparity continues

Booking Momentum by City – the table below compares daily bookings made as a % of 2019 volumes, comparing momentum across a section of different UK destinations.

Observations: a mixed bag across different regions, Cities with international appeal perform better:

- London and Edinburgh have performed well over the summer driven by pent-up demand from international travel. This will level out as summer ends, will the business traveller volumes return?

- 34% of all UK hotels booked in June were overseas visitors, 31% in July (in 2020 11.7% & 8.5% respectively). International volumes between 5 & 8% up on 2019.

- Regional cities are mostly still behind 2019, even Birmingham only 80% of 2019 during Commonwealth Games.

- Leisure, particularly coastal destinations have struggled, particularly when compared to strong staycations in 2020/ 21. Brighton circa 70% and Bournemouth only 60% of 2019 during high season weeks. Last-minute staycation cancellations are likely a factor, with a good volume of Brits preferring to go abroad.

- Demand now tailing off as the summer holidays draw to a close, will the business markets return in the numbers required?

Inflation pressures hitting revenues and margins

There is no denying that spiralling inflation is now the biggest threat but not just on cost increases. This will hit hotel spending from consumer and business markets, creating a double attack on margins. This is at a time when many businesses were still grappling with increased borrowing and deferred liabilities from 2020/21. Forecasts will therefore need to be accurate and growth actions more creative than ever.

Despite the gloom and doom, there is still plenty of opportunities to mitigate these risks. So in the coming months, we will be issuing insights and support solutions as the hotel and wider hospitality sector start to navigate this critical phase into a very difficult 2023.

Welcome to Assured Hotels

Assured Hotels have launched a new website detailing how we offer specialist support to hotel owners and stakeholders, in Hotel Advisory and Asset Management capacities. We have been engaged in hotel turnaround and restructuring, trading insolvent businesses and the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, emphasising the development of the hotel’s senior management team and therefore better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.