Assured Hotels – Full Lifecycle Hotel Partner

Founded in 2008, Assured Hotels is a trusted advisor to owners and stakeholders throughout a hotel's lifecycle - from acquisition, growth, turnaround, and eventual exit.

Over the past 15 years, we have successfully worked with over 350 clients across all areas of the UK, from large, branded hotel groups to small independent family-owned businesses with only a handful of rooms.

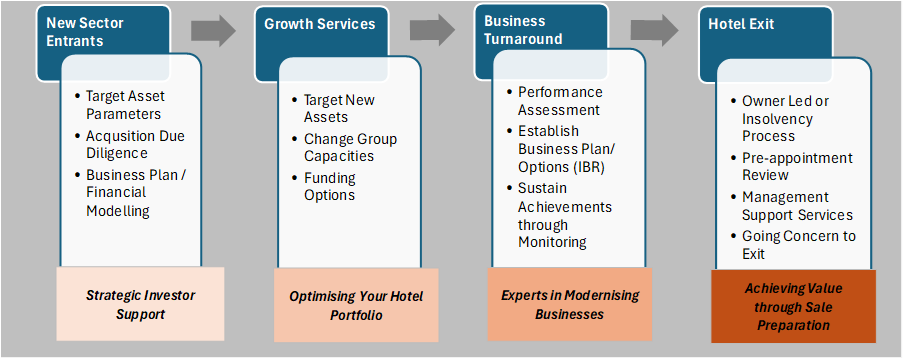

Assured Hotels Proposition

We deliver a full lifecycle hotel partnership proposition, with our services designed to allow us to become involved at any stage. Offering complete flexibility in our engagement. our core services include:

Our experience is demonstrated in various case studies on our website - Hotel Projects Portfolio | Assured Hotels

Solution Based Approach

The sector has been through a lot of challenges in the past 5 years, risks that existed before March 2020 were artificially overcome during the pandemic, and we now face more difficult period, where a retracting economy with rising costs against falling incomes is a reality. There are clear diverging fortunes where some city locations and up-scale markets have exceeded 2019 KPI’s compared to many regions where RevPAR is still behind, so local unit level pressures while varied will be location specific.

Despite volatile trading funding options are now improving, although the cost of debt remains high. Assured Hotels approach cases with an emphasis on sustainable solutions through an initial no obligation assessment:

Risks/ threats will include:

- Revenue regression, regional differences, staycation unattractive.

- Market mix - Corporate slow & leisure demand low.

- Margin/ cash pressures, increased costs, labour and debt.

- CAPEX spend, refurbishment and compliance “on hold”.

- Director/ operator fatigue, often in the business day to day.

- Market value, trading uncertain & constrained decisions.

Solutions could include:

- Management support, options to introduce interim services.

- Stress test financial models, 3rd party cash flow perspective.

- Potential for refinance / funding options.

- Restructure management, outsource back office.

- Rationalisation of portfolio, disposal of non-core assets.

- Planned approach to exit, value preservation.

Our Team of Experts - Click Here

Our people set us apart. We are each expert in our given field with experience in finance, business management, hotel operation, revenue management, PR, sales and marketing, procurement, human resources and law, all coming together to provide you with an outstanding resource to turn around, develop and progress your business.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

Hotel Market Overview - warning signs of hotel distress

For the remainder of 2023, a sector to keep a close watch on will be hospitality, where the warning signs of hotel distress are currently more difficult to identify. In this short article we have set out intel and data which suggest true underlying performance is camouflaged .

Trading Revenue Weathering the Headwinds

The hotel and wider hospitality sector continue to prove its repeated resilience, against significant ongoing challenges, over a period now approaching 3 years. Particularly trading revenues weathering the headwinds, despite what seems to be a continually evolving permanent crises.

All very good news it would seem and rather unexpected. Particularly if we look back at early commentaries and forecasts expecting a period of years for the top-line to return to 2019 levels.

Strong Recovery Disguised?

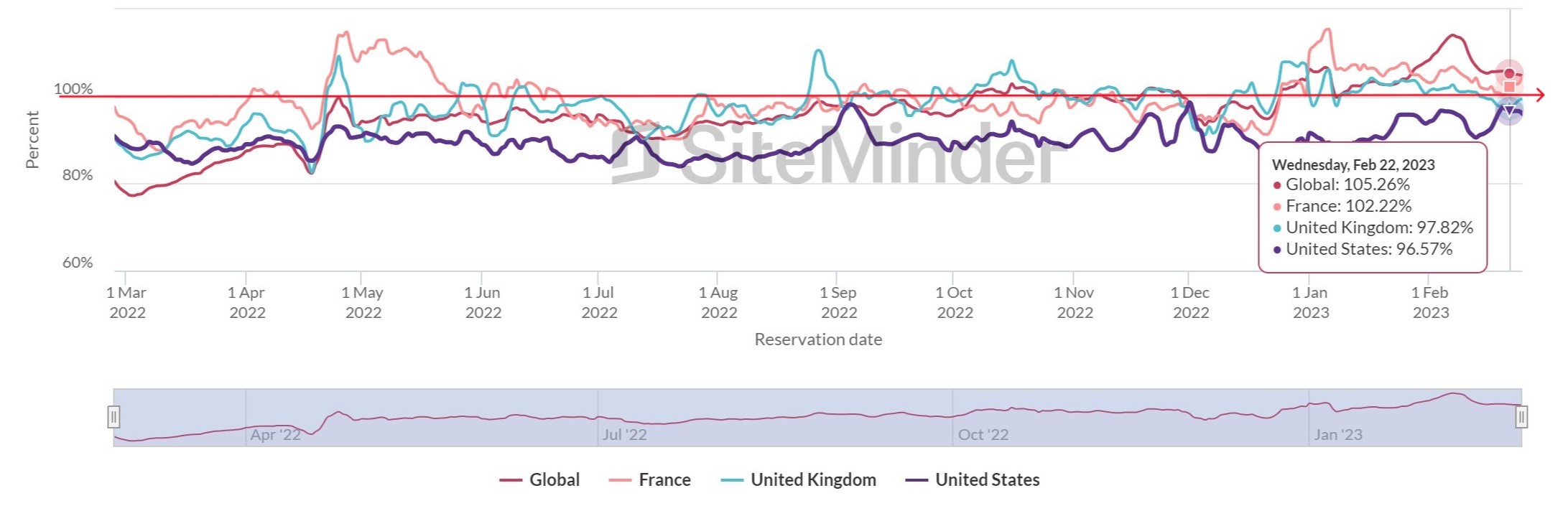

A simple comparison with 2019 hotel bedroom demand available on SiteMinder World Hotel Index in the graphic below shows us that strong hotel demand continues and is generally on a par with pre-pandemic occupancy in the UK and across other similar economies. Additionally in the UK, bedroom pricing is pacing ahead, and therefore RevPAR should also be well ahead of where we were before the pandemic.

But is it all good news? It could be dangerous to look at selected truths, particularly when warning signs of hotel distress are hidden.

Bottom Line Realities

Occupancy and top-line revenues are only part of the picture. In many locations the true underlying performance has been skewed by pent up demand and changed behaviours from pandemic restrictions. This has created buoyant but fluctuating rooms performance in many locations, and on top of residual pandemic support cash, created a false recovery trends and misplaced confidence in cash flows.

Add to this the reported 200 hotels taken “off market” for use by Home Office in contracts to ease the escalating asylum crisis, we can quickly see the 2019 comparison becomes an arbitrary and inaccurate benchmark. Put another way we aren’t aware of competition capacities and demand in many locations – we know the Home Office are looking at cheaper alternatives to curb the £7m daily cost of these hotels, so contract terms need to be scrutinised.

For any individual business the only transparent reality is the bottom line. Rising costs, utilities and overheads, together with labour shortages causing salary increases and reduced operational capacities all eroding profit margins. Factor into this mix balance sheet forbearance, increased borrowing and fluctuating profit reporting amongst other lockdown legacy issues not yet addressed.

Warning signs of hotel distress, what we look for

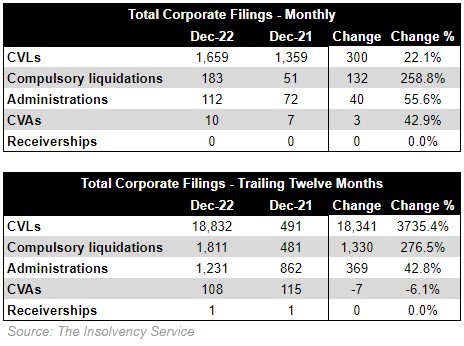

The sector was beginning to slide in 2019 before the subsequent disruption. Since March 2020 many directors and their management teams have spent the last almost three years in survival mode. Voluntary arrangements and liquidations make up the majority of the growth in insolvency process, or down load a more user friendly snap shot of administration trends here. Additionally there hasn’t been normal creditor pressure until recently. We are also aware of many banks and funders continuing to take a back seat on loan covenants. All of this amounts to a masking of the warning signs of hotel distress.

A lack of recognised checks and balances has created a disconnect between interested parties and stakeholders - a dangerous combination. Conventional trading in an economic downturn will require clear communication. A period ahead that will prove even more difficult than 2020 to 2022. We can also confidently assume that there won’t be any central support, despite the regular calls through the media.

Red flags and significant risks could therefore include:

- Management teams slow or reluctant to update forecasts and monthly MI.

- Younger management, a decade of growth since 2012, begs the question have senior personnel got the experience without support?

- Forecasts overstated & not met, don’t include cash flows. Margin squeeze not accurately reflected

- Cash running out – pandemic has created a handout culture.

- Lack of credible MI – demand/ competitor analysis, pricing & distribution strategy doesn’t reflect the current crises.

- Lack of market coverage – leisure markets have been best performers. If consumer spend contracts an over-reliance on one market would impact cash flows.

- Mid-market 3 and lower 4 star, shrinking market share, squeezed out on rate and quality by premium and limited-service hotels.

- Location & competition – pricing needs to cover inflationary pressure, but can it whilst remaining competitive?

- Unbranded owner/ operators exposed, new build pipeline.

- Valuation how has the patchy trading affected bricks and mortar value, should exit be an option?

Hotels are normally among the first to see effects of a recession, often termed the “canary in the mine”. We are seeing these distressed markers already in some regions, so early action is always essential.

Gloomy, yes, but help is at hand.

Founded in 2008, Assured Hotels is a UK based management company that offers specialist support to hotel owners and stakeholders. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

Assured Hotels maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email info@assuredhotels.co.uk or call 0203 916 5658.

Supply Chain Support - Restaurant, Bar & Hotel sector

Amongst the hardest hit during the pandemic were the hospitality sector and its supply chain. Central support and positive recovery to trading in 2022 has consequently meant many businesses have survived intact, some even flourished.

Difficult winter ahead, economic challenges exposing legacy issues

However, many of the risks that existed before March 2020 have been artificially overcome during the pandemic so the outlook will be bleak for some. Difficult decisions will have to be made without central support making the period ahead more challenging than the past 3 years. The certain reality in a retracting economy is rising costs across the supply chain also against falling incomes.

Energy and utility costs are grabbing most of the headlines as we have discussed in recent blogs, and as a direct result many other parts of the supply chain are also eroding already tight margins. Basic cost of sales such as food, beverage and other everyday items are in an ever upward cycle, with many essential categories twice the price of 2019.

Supportive solutions available

At Assured Hotels we have long established supply partners who we know we can trust to improve supply chain and additionally commercial benefits. This experience is tried and tested on our recent case studies, therefore, to highlight solutions and initiatives we focus on food supply with our partner Entegra Europe.

Entegra are a savings solutions partner, working across the hospitality sector to improve the profit margins of their clients. Operating with a self-funding, savings-led model, they remove any up-front costs or risk. They specialise in procurement services, delivering operational margin improvement and providing system solutions to enable clients to protect their profit margin and deliver improved operational efficiency.

Unlocking supply chain potential

The food “basket” is complex with many categories performing differently with supply sources across the world, so we have shared Entegra’s detailed monthly market report here. Highlights of this report include:

- Food categories, how individual food types have fared and insights on what future trends look like.

- Summary of current challenges and how factors such as energy and exchange rates are impacting food and general supply chain.

- Seasonal produce for the winter, Christmas and beyond across all categories.

- Outlook across non-food, inflation, fuel and other contributing trends

Price & availability data – access to allow for better planning to protect margins

This is probably the number one challenge for Chefs and managers with their supply chain, so we conclude with a case study. This analysis shows October price movement into November and more importantly how our support with Entegra’s purchasing power and experience could help against open market supply chain.

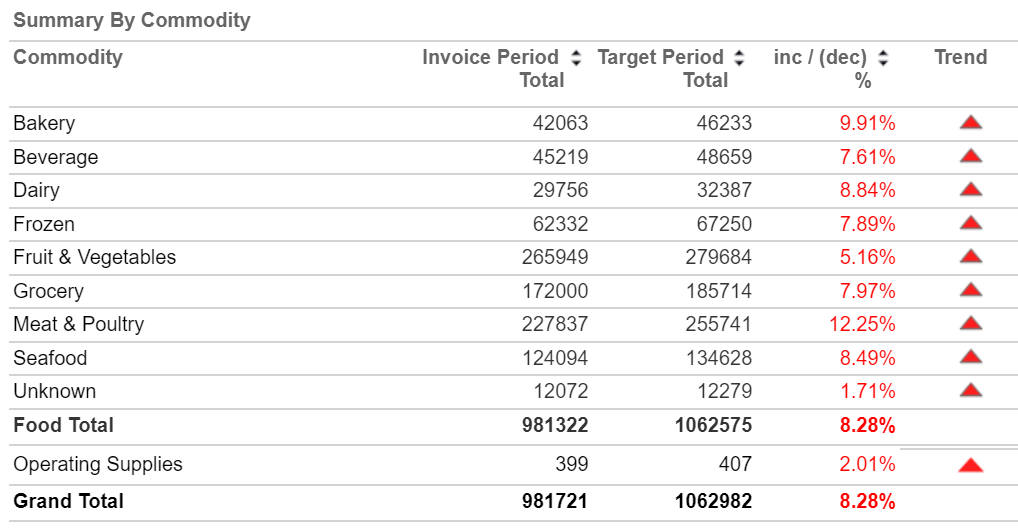

Steep year on year rises - the table below shows a £100k unit food spend taken from the management dashboard. Year on year the same business spent over 8% more for the same basket, to service similar incomes. Increases are much higher in some categories than others.

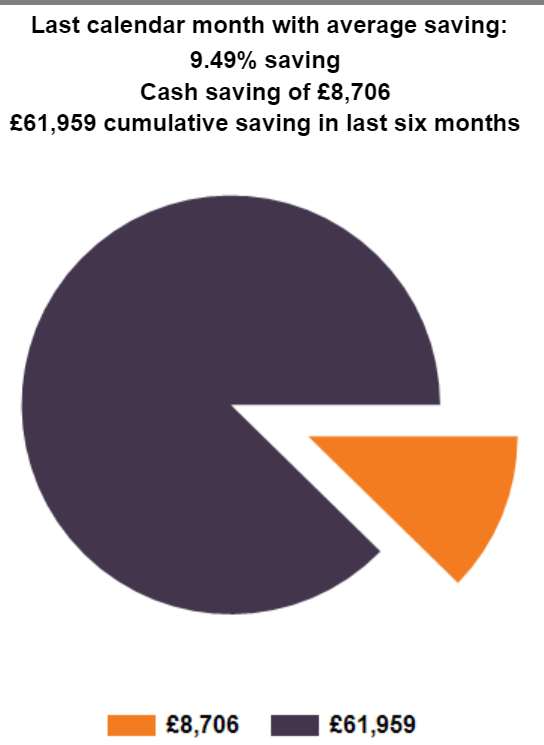

Managed versus unmanaged supply - through a supply partnership the savings on this basket over a 6-month period are almost £62k. The chart below from the dashboard shows managed pricing against open market price data.

Working with a procurement partnership with Assured and Entegra will provide:

Preparation - price “ghosting” analysis, to demonstrate actual savings

Preparation - price “ghosting” analysis, to demonstrate actual savings

Account management – operational & commercial support including:

- Monthly ops review including price movements, best practice, and lost opportunity recommendations.

- Live reporting between ops teams and financial controller through cloud-based software.

- Menu costings, written not only to maximise margins but also payroll cost and team capabilities.

Price files guaranteed for a month, any "big shocks" flagged.

Legal support – changes to regulations and support on operational impact, including allergens, food safety and general kitchen management.

We would suggest a review of all supply and operational process is a must. This would be on a no obligation basis, and opportunities in all food and non-food categories identified in a "Ghosting Report"

Welcome to Assured Hotels

Assured Hotels offer specialist support to hotel owners and stakeholders, especially in Hotel Advisory and Asset Management capacities. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

Or to contact Entegra direct, Iain Shaw email iain.shaw@entegraps.uk or call+44 (0)7774 785 027

Hotel Cost Management Support – labour shortages & payroll costs

The cost-of-living crisis has grabbed all the headlines and indeed everybody’s attention, and whilst all of the current challenges are linked, labour shortages and controlling payroll costs have dropped down the media’s priority list of importance.

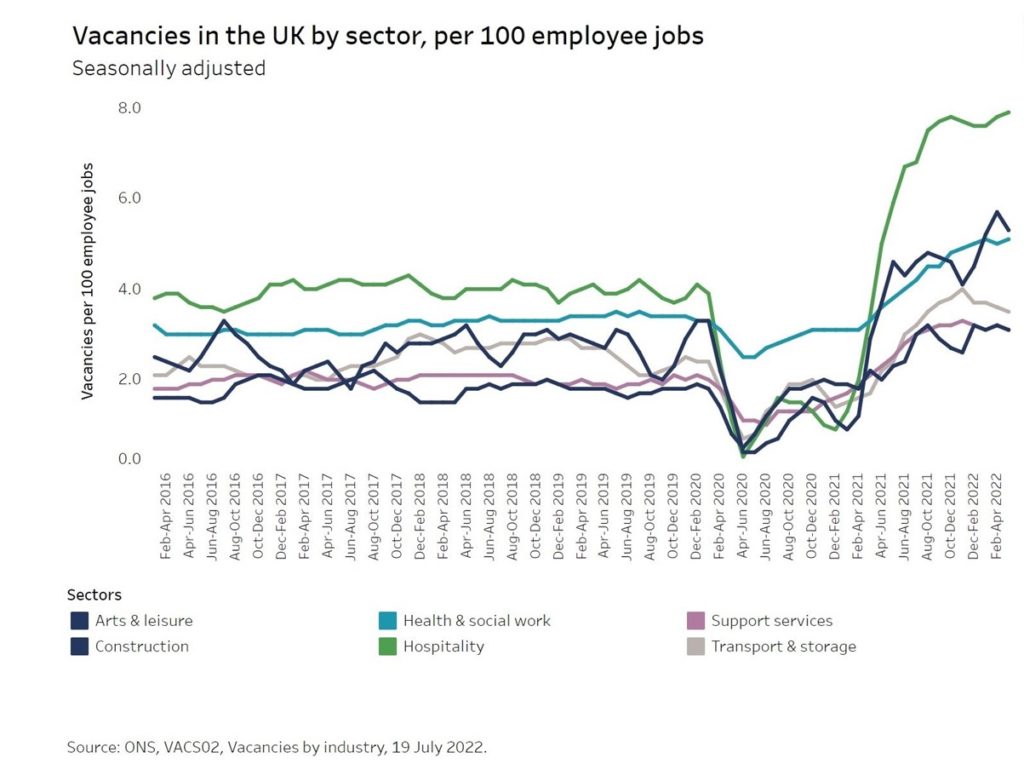

Labour shortages and payroll costs remain significant challenges which won't just disappear. The lack of personnel with the right skills and experience directly increases the cost of attracting and retaining the right people. We can see in the graphic below that the hospitality sector in the UK is fairing the worst by some distance amongst other similar-sized service-based sectors. As a result, we have seen some businesses forced to limit operating hours or even close facilities due to shortages.

In the current climate, limiting revenue-earning capacities can’t be a strategy of choice.

There are initiatives we can advise on and support hospitality and hotel businesses with, which include:

- Attracting more workers from the UK workforce, for example by raising wages, improving working conditions, or being more flexible on hours and contracts;

- Recruiting workers from abroad, usually by sponsoring them on a work visa*;

- Reducing the need for workers, for example by introducing automation by streamlining operations and administrative controls.

UK businesses are able to implement all of these initiatives now, including using immigration rules. Assured hotels can assist in assessing all available opportunities which could make a big difference in maximising income and controlling the highest cost in most trading businesses, ultimately converting better margins.

*Government policy post-Brexit means there are limitations however sponsorship is available as it stands.

Additional reading and resources on recruitment, retention, and labour costs in the UK….

- Staff shortages in the hospitality & retail sector – What help is there under the UK immigration rules? | Anderson Strathern

- How is the End of Free Movement Affecting the Low-wage Labour Force in the UK? - Migration Observatory - The Migration Observatory (ox.ac.uk)

Welcome to Assured Hotels

Assured Hotels offer specialist support to hotel owners and stakeholders, especially in Hotel Advisory and Asset Management capacities. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

Hotel Cost Management Support – protecting the bottom line

As we continue to face economic headwinds, and despite the Government and the Bank of England working on what appears to be opposing strategies, we continue to focus on the job at hand. There is plenty of scope for meaningful change to shore up margins through our latest observations on hotel cost management support to protect the bottom line.

At present there is a substantial saving grace with top-line revenues holding up to 2019 levels, the latest data suggests that demand and rate are as we were a month ago when we issued this demand snapshot.

Costs however are only going one way, and in the coming weeks we will issue the following content:

- General procurement, supply chain support, and how our partner network can achieve significant savings through a managed approach.

- Human resource and recruitment support, including opportunities to manage payroll costs, plus ideas on attracting and retaining the right people.

- Continued focus on utility costs, consumption reducing initiatives and further details on the Government’s Energy Bills Support package.

Relevant Turnaround Case Study – project Bumblebee

Our assignment and scope in this case study were agreed directly with the business owner where margins had reduced over a two-year period through both sales regression and poor management of costs & payroll. This resulted in a poor EBITDA conversion of less than £350k, a margin of just over 8%.

We set a turnaround plan in place with the support of stakeholders and our partner network:

- Payroll - achieved £280k annual savings.

- Overhaul of the sales mix, to drive a room’s revenue focus.

- Procurement policies established.

- Controls and reporting implemented.

We used these initiatives and more to achieve EBITDA growth to £1m (20% margin) within 12 months, facilitating a refinance and start of a long overdue CAPEX refurb plan.

Assured Hotels offer specialist support to hotel owners and stakeholders, especially in Hotel Advisory and also Asset Management capacities. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

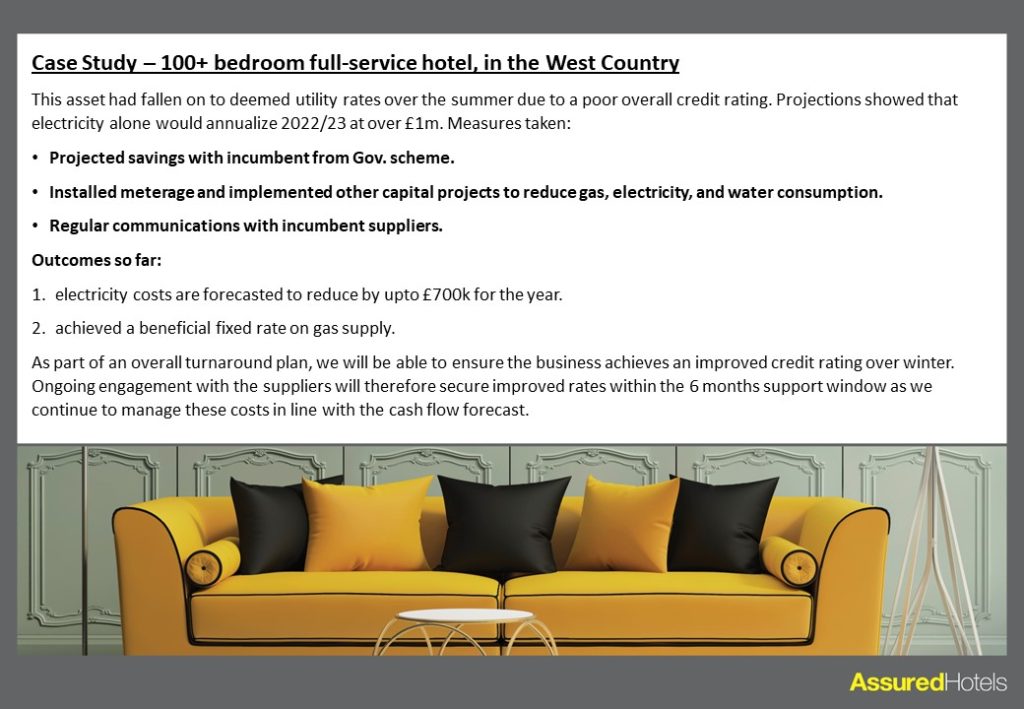

Hotel Cost Management Support - Government Energy Bill Relief Scheme

Reflecting on last week’s reaction to the Chancellors' “mini-budget” it would be easy to get swept away in the chaos and anger played out in the media on what might happen next. However, there is still good news by focusing on what we can control at an individual business level. Our article last week summarized recent turnaround case studies, where early intervention planning prevented terminal outcomes. The energy bill relief will play a crucial part in future turnarounds and as promised we set out the main scheme details.

GOVERNMENT SUPPORT – The Basics

In a bid to provide a degree of certainty for businesses, the Government announced the Energy Bill Relief Scheme to help protect them from rising energy costs.

How does the Energy Bill Relief Scheme work?

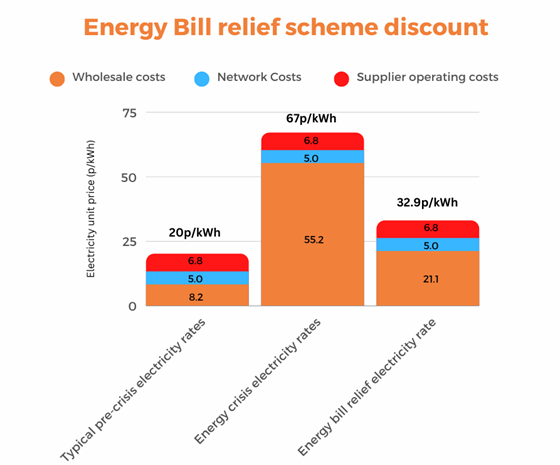

The scheme which started on 1st October 2022, will provide energy bill relief for businesses in the form of a discount on gas and electricity unit prices. The discount only applies to the wholesale cost of the energy.

The baseline “government supported price” will form the comparison to the estimated unit price a business would be paying during the period 1 October 2022 and 31 March 2023. This will establish the wholesale discount.

The per kWh supported price has been set at:

- £0.21 per KWH for electric

- £0.075 per KWH for gas

The relief on current wholesale energy prices should therefore be around 40%. The table below demonstrates KWH costs and distribution margins, with the 67p typical unit cost pre-the 1st of October.

The scheme will run for a six-month period from 1st October 2022 with a review after the initial 3 months. This will establish ongoing support after March 2023 for vulnerable industries.

Who is eligible?

The scheme is available to all businesses in England, Scotland and Wales who are:

- On existing fixed price contracts that were agreed on or after 1 April 2022

- Signing new fixed-price contracts

- On deemed/out of contract variable tariffs

- Flexible tariffs

The p/KWH government support for comparable contracts will be the same across suppliers, but the level of individual bills will vary. A similar scheme is due for Northern Ireland.

Help is at hand

As the energy relief only impacts your bill’s wholesale element, there’s still a need for businesses to look at energy management as suppliers continue to compete to offer the best prices. We work with a network of specialist partners, including energy brokers who support Assured Hotels' experienced team.

In addition to the short-term support and switching energy suppliers, we have the resource and expertise to identify initiatives to improve cash flow. This will include meterage improvements and CAPEX projects, all driving a green ethos that will improve margins.

To receive our cost management, revenue growth and other industry blogs direct to your inbox, click here.

Assured Hotels offer specialist support to hotel owners and stakeholders, especially in Hotel Advisory and also Asset Management capacities. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

Co-authors:

Mathew Griffin, Managing Director, Assured Hotels Assured Hotels

Dawn McHardy, Business Development Manager, EV Solutions

Hotel Cost Management Support – Assured Hotels Turnaround Case Studies

The Energy Bills Support package announced by the Government last week was very welcome news, we have worked through the detail and will be publishing comprehensive guidance outlining utility cost management. This however is only part of the story, as pressures from declining revenues and rising costs across the board continue to erode margin and cash.

Most of our current caseload is trading administrations, where we are assisting stakeholders to preserve value to an exit. We can see that insolvencies of all types are returning 2019 levels, which given the pressures on trading businesses is inevitable.

However, these very final outcomes are avoidable in many cases. We are highly experienced in advising on hotel turnaround and restructuring. We therefore highlight several successful hotel projects where early intervention has made a difference:

Hotel turnaround to achieve refinance - 150 bed hotel with multiple outlets, in the Northwest

Group turnaround to disposal – hotel group consisting of 600 keys generating £20m annual turnover in the North of England

Single asset management led turnaround – lighter touch advisory support to the management team, of a 44-bedroom Southwest hotel

Welcome to Assured Hotels

Assured Hotels offer specialist support to hotel owners and stakeholders, in both Hotel Advisory and Asset Management capacities. We have been engaged in hotel turnaround and restructuring, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with emphasis on the development of the hotel's senior management team and therefore better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.