Hotel Market Overview - warning signs of hotel distress

For the remainder of 2023, a sector to keep a close watch on will be hospitality, where the warning signs of hotel distress are currently more difficult to identify. In this short article we have set out intel and data which suggest true underlying performance is camouflaged .

Trading Revenue Weathering the Headwinds

The hotel and wider hospitality sector continue to prove its repeated resilience, against significant ongoing challenges, over a period now approaching 3 years. Particularly trading revenues weathering the headwinds, despite what seems to be a continually evolving permanent crises.

All very good news it would seem and rather unexpected. Particularly if we look back at early commentaries and forecasts expecting a period of years for the top-line to return to 2019 levels.

Strong Recovery Disguised?

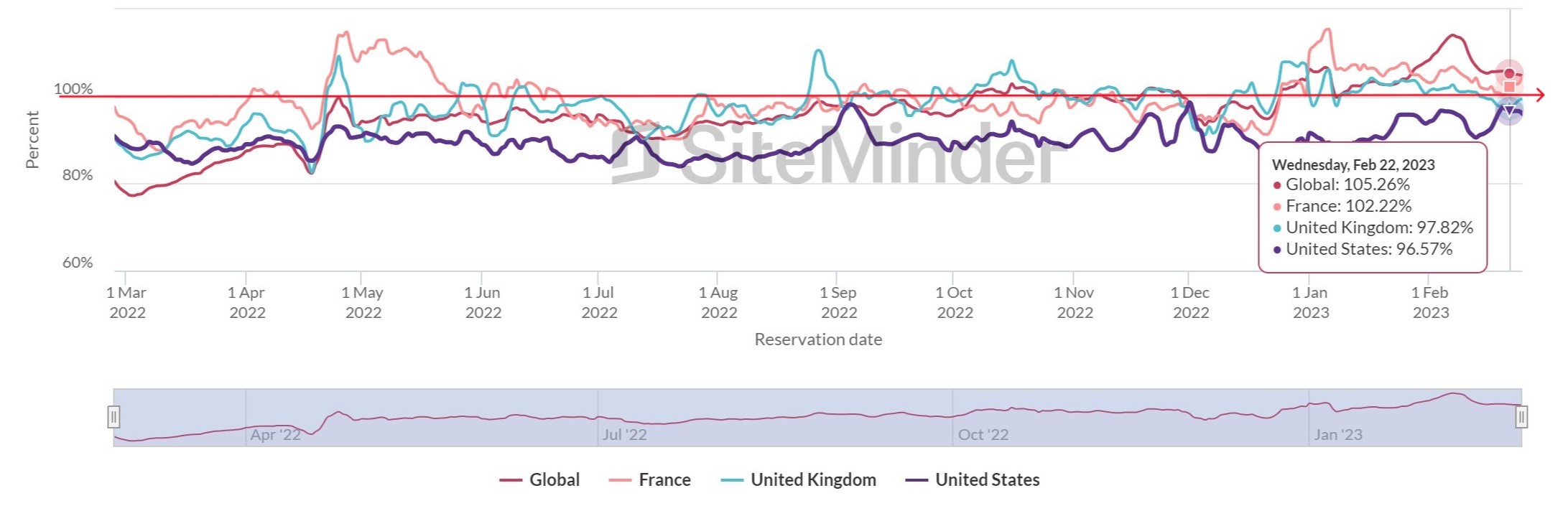

A simple comparison with 2019 hotel bedroom demand available on SiteMinder World Hotel Index in the graphic below shows us that strong hotel demand continues and is generally on a par with pre-pandemic occupancy in the UK and across other similar economies. Additionally in the UK, bedroom pricing is pacing ahead, and therefore RevPAR should also be well ahead of where we were before the pandemic.

But is it all good news? It could be dangerous to look at selected truths, particularly when warning signs of hotel distress are hidden.

Bottom Line Realities

Occupancy and top-line revenues are only part of the picture. In many locations the true underlying performance has been skewed by pent up demand and changed behaviours from pandemic restrictions. This has created buoyant but fluctuating rooms performance in many locations, and on top of residual pandemic support cash, created a false recovery trends and misplaced confidence in cash flows.

Add to this the reported 200 hotels taken “off market” for use by Home Office in contracts to ease the escalating asylum crisis, we can quickly see the 2019 comparison becomes an arbitrary and inaccurate benchmark. Put another way we aren’t aware of competition capacities and demand in many locations – we know the Home Office are looking at cheaper alternatives to curb the £7m daily cost of these hotels, so contract terms need to be scrutinised.

For any individual business the only transparent reality is the bottom line. Rising costs, utilities and overheads, together with labour shortages causing salary increases and reduced operational capacities all eroding profit margins. Factor into this mix balance sheet forbearance, increased borrowing and fluctuating profit reporting amongst other lockdown legacy issues not yet addressed.

Warning signs of hotel distress, what we look for

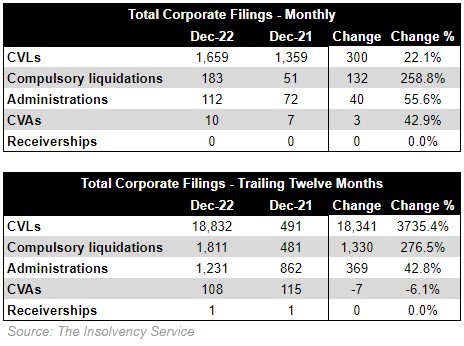

The sector was beginning to slide in 2019 before the subsequent disruption. Since March 2020 many directors and their management teams have spent the last almost three years in survival mode. Voluntary arrangements and liquidations make up the majority of the growth in insolvency process, or down load a more user friendly snap shot of administration trends here. Additionally there hasn’t been normal creditor pressure until recently. We are also aware of many banks and funders continuing to take a back seat on loan covenants. All of this amounts to a masking of the warning signs of hotel distress.

A lack of recognised checks and balances has created a disconnect between interested parties and stakeholders - a dangerous combination. Conventional trading in an economic downturn will require clear communication. A period ahead that will prove even more difficult than 2020 to 2022. We can also confidently assume that there won’t be any central support, despite the regular calls through the media.

Red flags and significant risks could therefore include:

- Management teams slow or reluctant to update forecasts and monthly MI.

- Younger management, a decade of growth since 2012, begs the question have senior personnel got the experience without support?

- Forecasts overstated & not met, don’t include cash flows. Margin squeeze not accurately reflected

- Cash running out – pandemic has created a handout culture.

- Lack of credible MI – demand/ competitor analysis, pricing & distribution strategy doesn’t reflect the current crises.

- Lack of market coverage – leisure markets have been best performers. If consumer spend contracts an over-reliance on one market would impact cash flows.

- Mid-market 3 and lower 4 star, shrinking market share, squeezed out on rate and quality by premium and limited-service hotels.

- Location & competition – pricing needs to cover inflationary pressure, but can it whilst remaining competitive?

- Unbranded owner/ operators exposed, new build pipeline.

- Valuation how has the patchy trading affected bricks and mortar value, should exit be an option?

Hotels are normally among the first to see effects of a recession, often termed the “canary in the mine”. We are seeing these distressed markers already in some regions, so early action is always essential.

Gloomy, yes, but help is at hand.

Founded in 2008, Assured Hotels is a UK based management company that offers specialist support to hotel owners and stakeholders. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

Assured Hotels maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email info@assuredhotels.co.uk or call 0203 916 5658.

Hotel Cost Management Support - Government Energy Bill Relief Scheme

Reflecting on last week’s reaction to the Chancellors' “mini-budget” it would be easy to get swept away in the chaos and anger played out in the media on what might happen next. However, there is still good news by focusing on what we can control at an individual business level. Our article last week summarized recent turnaround case studies, where early intervention planning prevented terminal outcomes. The energy bill relief will play a crucial part in future turnarounds and as promised we set out the main scheme details.

GOVERNMENT SUPPORT – The Basics

In a bid to provide a degree of certainty for businesses, the Government announced the Energy Bill Relief Scheme to help protect them from rising energy costs.

How does the Energy Bill Relief Scheme work?

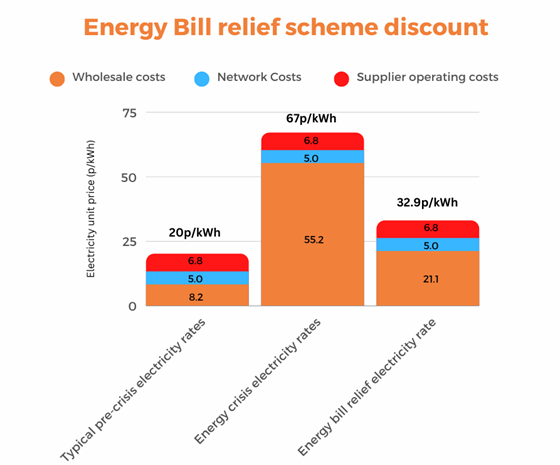

The scheme which started on 1st October 2022, will provide energy bill relief for businesses in the form of a discount on gas and electricity unit prices. The discount only applies to the wholesale cost of the energy.

The baseline “government supported price” will form the comparison to the estimated unit price a business would be paying during the period 1 October 2022 and 31 March 2023. This will establish the wholesale discount.

The per kWh supported price has been set at:

- £0.21 per KWH for electric

- £0.075 per KWH for gas

The relief on current wholesale energy prices should therefore be around 40%. The table below demonstrates KWH costs and distribution margins, with the 67p typical unit cost pre-the 1st of October.

The scheme will run for a six-month period from 1st October 2022 with a review after the initial 3 months. This will establish ongoing support after March 2023 for vulnerable industries.

Who is eligible?

The scheme is available to all businesses in England, Scotland and Wales who are:

- On existing fixed price contracts that were agreed on or after 1 April 2022

- Signing new fixed-price contracts

- On deemed/out of contract variable tariffs

- Flexible tariffs

The p/KWH government support for comparable contracts will be the same across suppliers, but the level of individual bills will vary. A similar scheme is due for Northern Ireland.

Help is at hand

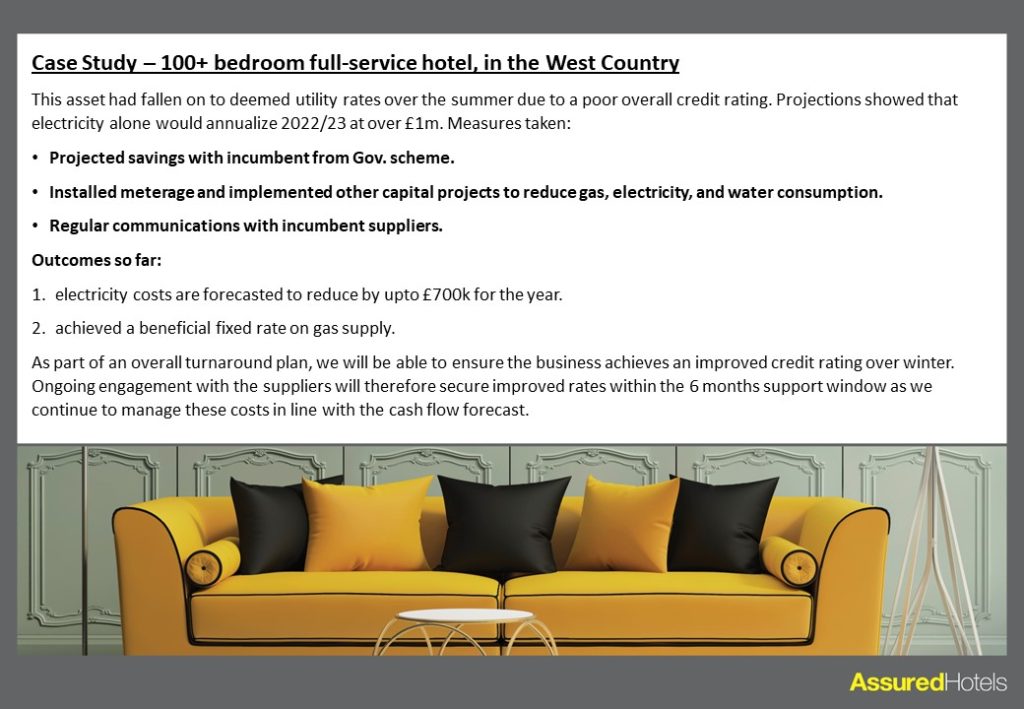

As the energy relief only impacts your bill’s wholesale element, there’s still a need for businesses to look at energy management as suppliers continue to compete to offer the best prices. We work with a network of specialist partners, including energy brokers who support Assured Hotels' experienced team.

In addition to the short-term support and switching energy suppliers, we have the resource and expertise to identify initiatives to improve cash flow. This will include meterage improvements and CAPEX projects, all driving a green ethos that will improve margins.

To receive our cost management, revenue growth and other industry blogs direct to your inbox, click here.

Assured Hotels offer specialist support to hotel owners and stakeholders, especially in Hotel Advisory and also Asset Management capacities. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

We maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email mgriffin@assuredhotels.co.uk or call 0203 916 5658.

Co-authors:

Mathew Griffin, Managing Director, Assured Hotels Assured Hotels

Dawn McHardy, Business Development Manager, EV Solutions

Routes to recovery - Understanding the restructuring plan

Partners at FRP Advisory discuss the restructuring plan, which is becoming an increasingly important option for businesses looking for a route to recovery.

HMRC "to go easy" on struggling UK companies

As companies grapple with factoring legacy liabilities into already challenging trading forecasts the FT highlights some positive news from HMRC. Its clear that the Government will seek to avoid harm to the economy and protecting businesses and jobs must be a priority, however timely and ongoing communication will be needed to achieve further forbearance.

Routes to recovery - the insolvency moratorium

The standalone moratorium process, which came into effect via the Corporate Insolvency and Governance Act last year, process could become an important option for businesses to consider as a route to recovery particularly as Government support reduces from the autumn.

https://www.frpadvisory.com/blog/leveraging-the-insolvency-moratorium/

RECOVERY - Issue 4 - Business Interruption insurance claims

Following the Supreme Court judgement in favour of the FCA’s appeals, and therefore business interruption policyholders, in January Assured Hotels summarise the main points and the best way forwards with a claim.

UK Court Rulings on Covid Insurance

The Supreme Court judgement in favour of the FCA’s appeals, and therefore Business Interruption policy holders, on the 15th of January finally brought some good news to our beleaguered industry. Kayleigh Fantoni of Clarion Solicitors in Leeds has written this concise and informative summary of the case which has run since last April and relates to insurers refusal to pay out for business interruption caused by the COVID pandemic, and focuses on that recent and welcome judgement in unanimous favour of policy holders.

Business-Interruption-Insurance-Blog

RECOVERY - Issue 3 - Hotel Asset Preservation

With lockdown v3 set to continue for at least two months and no certainty to when confidence will return to trade, Assured Hotels look at the difficultly of preserving cash and future asset value.

RECOVERY - Issue 2 - Winter Cash Flow Forecast

With consumer demand and confidence at rock bottom we start to look at planning for winter - cash flow whilst preserving asset value become more critical to ensure survival as an expectation and reliance on a reasonable trading top line income is no currently not achievable.

RECOVERY-Issue-2-Winter-Cash-Flow-Forecast