10 Essential Tips for Choosing the Perfect Hotel for Your Vacation

Planning a vacation involves many details, and choosing the right hotel can significantly impact your overall experience. Here are ten essential tips to help you select the perfect hotel for your next getaway, inspired by the expertise of Assured Hotels:

Identify Your Needs and Preferences: Determine what amenities and services are most important to you, such as Wi-Fi, breakfast, a pool, or a gym.

Consider the Location: Choose a hotel that is conveniently located near the attractions or activities you plan to visit.

Read Reviews and Ratings: Look for recent reviews on travel websites to get an honest perspective from other travellers.

Check the Hotel’s Website: Visit the hotel’s official website for the most accurate information and to discover exclusive deals.

Compare Prices: Use multiple booking platforms to compare prices and find the best deal. Don’t forget to check for hidden fees.

Understand the Cancellation Policy: Ensure you are aware of the hotel’s cancellation policy to avoid any surprises in case your plans change.

Look for Special Offers: Take advantage of special offers and packages that can add value to your stay, such as free breakfast or discounted rates.

Assess Safety and Cleanliness Standards: Post-pandemic, it’s crucial to choose a hotel that adheres to high safety and cleanliness standards.

Explore Loyalty Programs: If you travel frequently, joining a hotel loyalty program can offer significant benefits and savings.

Contact the Hotel Directly: Sometimes, contacting the hotel directly can result in better rates or special accommodations that aren’t available online.

Selecting the right hotel is crucial for ensuring a memorable and stress-free vacation. By applying these tips and conducting thorough research, you can identify a hotel that meets your specific needs and enhances your overall travel experience.

Hotel Market Overview - warning signs of hotel distress

For the remainder of 2023, a sector to keep a close watch on will be hospitality, where the warning signs of hotel distress are currently more difficult to identify. In this short article we have set out intel and data which suggest true underlying performance is camouflaged .

Trading Revenue Weathering the Headwinds

The hotel and wider hospitality sector continue to prove its repeated resilience, against significant ongoing challenges, over a period now approaching 3 years. Particularly trading revenues weathering the headwinds, despite what seems to be a continually evolving permanent crises.

All very good news it would seem and rather unexpected. Particularly if we look back at early commentaries and forecasts expecting a period of years for the top-line to return to 2019 levels.

Strong Recovery Disguised?

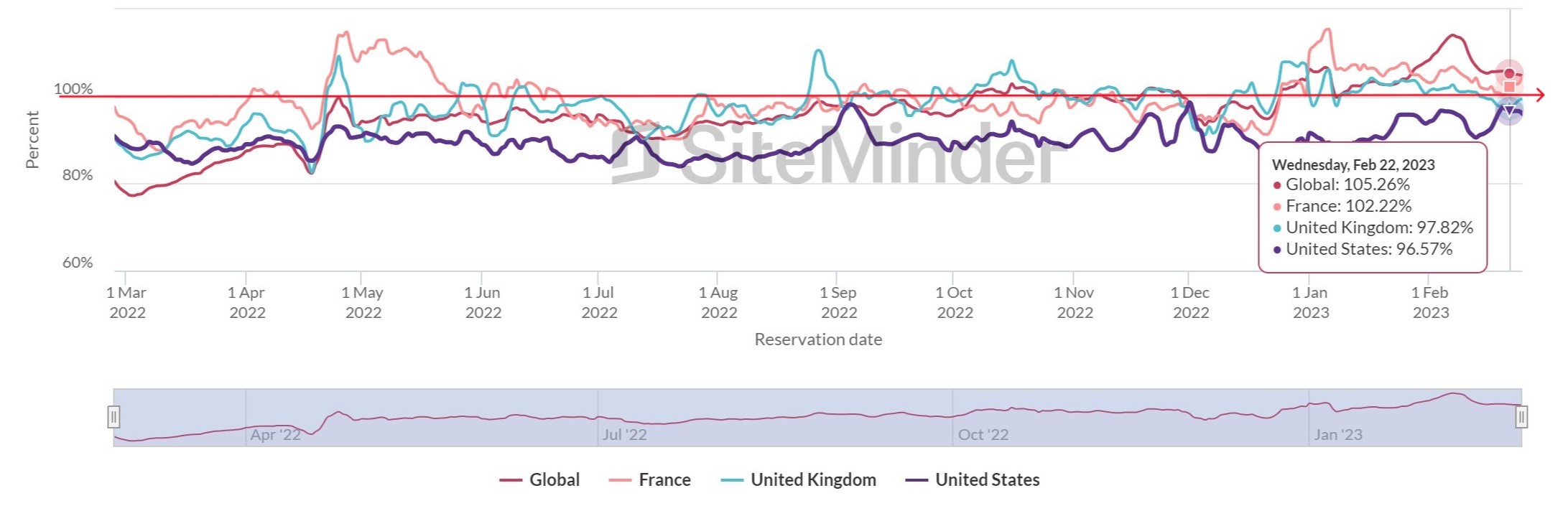

A simple comparison with 2019 hotel bedroom demand available on SiteMinder World Hotel Index in the graphic below shows us that strong hotel demand continues and is generally on a par with pre-pandemic occupancy in the UK and across other similar economies. Additionally in the UK, bedroom pricing is pacing ahead, and therefore RevPAR should also be well ahead of where we were before the pandemic.

But is it all good news? It could be dangerous to look at selected truths, particularly when warning signs of hotel distress are hidden.

Bottom Line Realities

Occupancy and top-line revenues are only part of the picture. In many locations the true underlying performance has been skewed by pent up demand and changed behaviours from pandemic restrictions. This has created buoyant but fluctuating rooms performance in many locations, and on top of residual pandemic support cash, created a false recovery trends and misplaced confidence in cash flows.

Add to this the reported 200 hotels taken “off market” for use by Home Office in contracts to ease the escalating asylum crisis, we can quickly see the 2019 comparison becomes an arbitrary and inaccurate benchmark. Put another way we aren’t aware of competition capacities and demand in many locations – we know the Home Office are looking at cheaper alternatives to curb the £7m daily cost of these hotels, so contract terms need to be scrutinised.

For any individual business the only transparent reality is the bottom line. Rising costs, utilities and overheads, together with labour shortages causing salary increases and reduced operational capacities all eroding profit margins. Factor into this mix balance sheet forbearance, increased borrowing and fluctuating profit reporting amongst other lockdown legacy issues not yet addressed.

Warning signs of hotel distress, what we look for

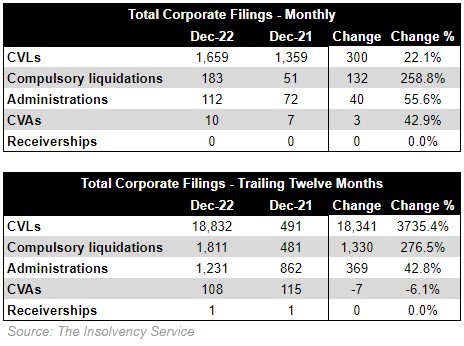

The sector was beginning to slide in 2019 before the subsequent disruption. Since March 2020 many directors and their management teams have spent the last almost three years in survival mode. Voluntary arrangements and liquidations make up the majority of the growth in insolvency process, or down load a more user friendly snap shot of administration trends here. Additionally there hasn’t been normal creditor pressure until recently. We are also aware of many banks and funders continuing to take a back seat on loan covenants. All of this amounts to a masking of the warning signs of hotel distress.

A lack of recognised checks and balances has created a disconnect between interested parties and stakeholders - a dangerous combination. Conventional trading in an economic downturn will require clear communication. A period ahead that will prove even more difficult than 2020 to 2022. We can also confidently assume that there won’t be any central support, despite the regular calls through the media.

Red flags and significant risks could therefore include:

- Management teams slow or reluctant to update forecasts and monthly MI.

- Younger management, a decade of growth since 2012, begs the question have senior personnel got the experience without support?

- Forecasts overstated & not met, don’t include cash flows. Margin squeeze not accurately reflected

- Cash running out – pandemic has created a handout culture.

- Lack of credible MI – demand/ competitor analysis, pricing & distribution strategy doesn’t reflect the current crises.

- Lack of market coverage – leisure markets have been best performers. If consumer spend contracts an over-reliance on one market would impact cash flows.

- Mid-market 3 and lower 4 star, shrinking market share, squeezed out on rate and quality by premium and limited-service hotels.

- Location & competition – pricing needs to cover inflationary pressure, but can it whilst remaining competitive?

- Unbranded owner/ operators exposed, new build pipeline.

- Valuation how has the patchy trading affected bricks and mortar value, should exit be an option?

Hotels are normally among the first to see effects of a recession, often termed the “canary in the mine”. We are seeing these distressed markers already in some regions, so early action is always essential.

Gloomy, yes, but help is at hand.

Founded in 2008, Assured Hotels is a UK based management company that offers specialist support to hotel owners and stakeholders. We have been engaged in turnaround and restructuring projects, trading insolvent businesses and in the acquisition or disposal of hotels on behalf of investors.

Assured Hotels maintain impartiality and independence free of any fixed portfolio, offering support services across all disciplines. This includes sales and revenue growth, marketing, finance and reporting, procurement, and compliance. Our flexible contracting ensures affordability, with additionally an emphasis on the development of the hotel’s senior management team. We believe this creates better returns for investors and stakeholders.

Please click here to book a meeting, email info@assuredhotels.co.uk or call 0203 916 5658.

Lambert Smith Hampton - Hotels Update April 2020

Further realistic insight from the team at LSH, positivity highlighted where opportunities will exist in the recovery phase focused on the need for adapting and embracing the new situation. Includes market commentary and some useful insights into the specific types of hotels, locations and facilities that should perform better if the right balance between flexibility, safety and hospitality is achieved.